Positioning for What’s Ahead

A conversation with Kgori Capital’s Portfolio Management Team

- Alphonse Ndzinge, CFA – Managing Director;

- Tshegofatso Tlhong, CFA – Portfolio Manager;

- and Kwabena Antwi, CFA, MBA, FCCA – Investment Analyst

QUESTION: What is your latest outlook for the domestic economy in 2018 following the appointment of His Excellency Mokgweetsi Masisi as President of the Republic of Botswana?

ANSWER: Our inflation view remains unchanged from the start of the year. We still expect inflation to increase to the mid-range of the Bank of Botswana’s 3-6% objective range with risks balanced. The main upside risk relates to administered prices. Electricity and public transportation prices were increased by 10% and 14%-25% respectively, effective April 2018. Further price increases in water and fuel prices may drive inflation further up. The main risk to the downside emanates from continued tepid domestic demand.

We expect the Central Bank to maintain its current accommodative monetary policy stance in order to support economic growth. That said, we do not expect the Bank of Botswana to reduce rates further unless inflation continues to trend below its objective range. We do not expect this to be the case on account of increases in administered prices.

We are projecting GDP growth of about 4.0% for 2018 compared to the latest MFDP’s forecast of 5.3%. This represents solid but unremarkable growth. Any significant upside surprise will be driven by a combination of a spike in Government spending, the continued revival of the diamond market, above trend growth in the non-mining sector and the stability of water and electricity supply.

The newly inaugurated fifth President, H.E. Mokgweetsi Masisi, and his Administration accept that, now more than ever, there is a dire need to improve economic diversification execution. This will direct economic policy and strategy formulation during his term. Government has publically committed to a partnership with the private sector that focuses on giving Batswana an opportunity to set up industries that empower themselves and, in turn, to create much needed employment.

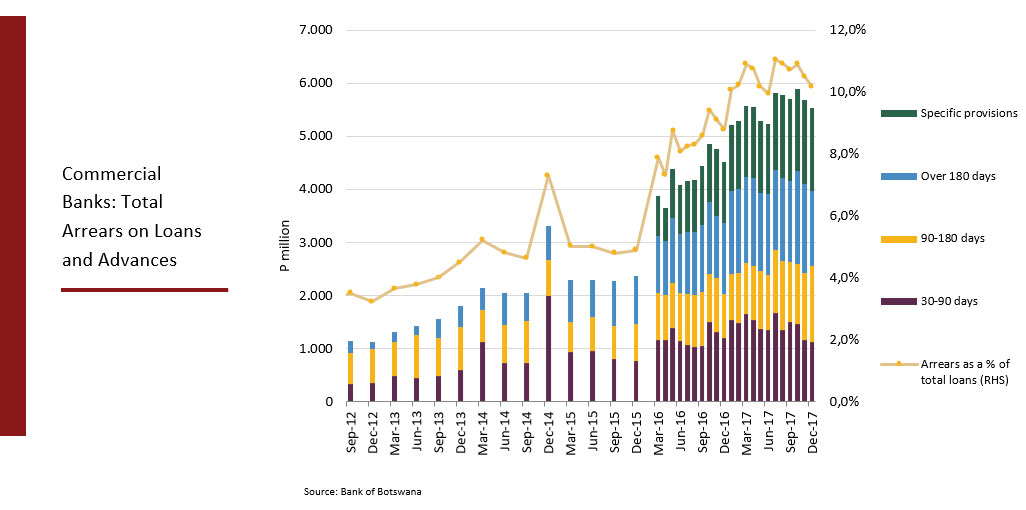

QUESTION: What are the biggest risks in your view to local banks?

ANSWER: The key issue facing the local banking sector remains the implementation and impact of IFRS 9. The implementation will affect retained earnings, and therefore capital adequacy, as well as increase the impairment charge for the year. Due to the large component of unsecured loans on bank balance sheets, we anticipate the impairment impact will be large and may alter the product mix of banks going forward. Given the current rate environment, coupled with a lower-for-longer expectation, players are looking to ramp up their non-interest income to fuel top-line growth. We expect banking stocks to continue the decline in the short-term, with FNB faring better than competitors because it has a larger non-interest income earning base and it has more attractive valuation metrics.

QUESTION: Would you agree that the property sector is likely to continue to outperform?

ANSWER: We are seeing increased deal activity in the property space as companies poise for growth and currency exposure diversification. Zambia seems to be a favoured destination regionally due to attractive USD linked yields coupled with the relatively underdeveloped nature of the market. Locally, property prices and rentals are under pressure due to the constrained consumer environment, thereby presenting acquisition opportunities. Property counters continue to deliver stable price returns and attractive dividend yields and thus remain in favour.

QUESTION: Have recent economic data releases impacted Kgori Capital’s view of retail companies?

ANSWER: The formal sector is under pressure, wage inflation remains low, jobs are being shed and companies rationalised; however consumption continues to grow. This growth is fuelled by the informal sector whose spending habits and preferences differ; it is no longer about whether people are spending but what people are spending on. Consumption shifts have resulted in consumers moving to lower margin products and loss-leaders, impacting company profitability. Regional expansion has cushioned the impact to some degree but the consumer retail sector remains stressed. We maintain our unfavourable view of the sector.

QUESTION: How are fundamentals looking for the hospitality and leisure sector?

ANSWER: The trends in travel are shifting and competition is heating up. The entrance of more hotel chains, mushrooming of guest houses and adoption of alternative accommodation means such as Air BnB has put Cresta under pressure. We expect the luxury tourism sector to remain buoyant given positive global growth trends; therefore, the sector will continue to outperform.

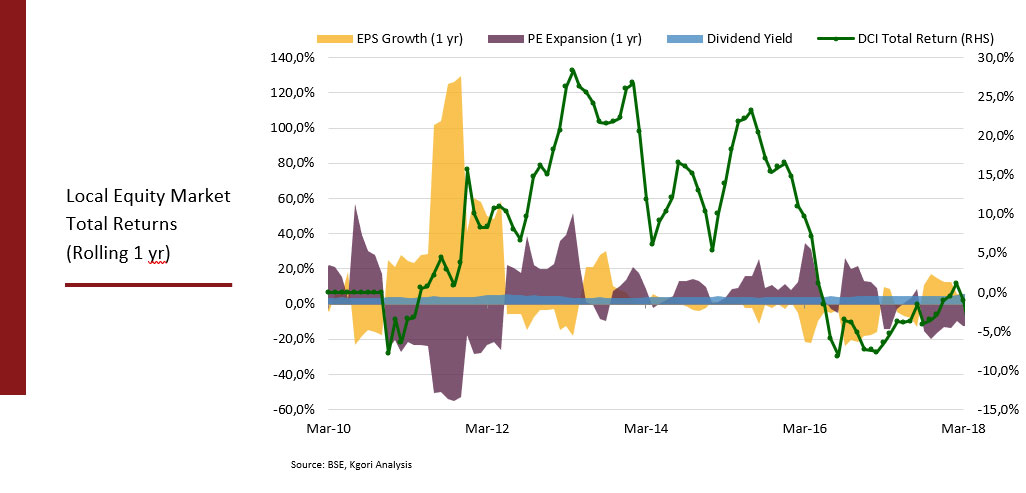

QUESTION: What are Kgori Capital’s expectations for prospective local equity market returns?

ANSWER: Since the DCI peak in August 2015, local equity investors have suffered from low to negative returns. On a total return annualised basis for the last 1 year, 3 years, and 5 years local stocks have returned -3.7%, -0.7%, and 4.2% respectively. On a relative basis, local equities have underperformed local bonds, cash and most global asset classes. Unfortunately, we expect the slump for local stocks to continue in the short-term, based both on continued weak fundamentals and negative retail investor sentiment.

However, looking further out and more importantly in line with Kgori Capital’s investment horizon of three to five years, we are a lot more positive on prospective local equity market returns improving. By combining our bottom up analysis and top down insights on the key fundamental drivers for equity returns of price/earnings (P/E) ratio, earnings growth, and the dividend pay-out ratio, we have determined that the forward looking return profile is starting to make holding local equities a much more attractive proposition. This is underpinned by one of our main investment themes of improving earnings momentum on more attractive entry valuations. We believe investors should focus more on what we expect will be the real driver of the markets going forward, earnings growth.

In recent years, domestic economic growth has often been patchy and corporate earnings fitful, but growth in 2018 is expected to be more broad-based, while corporate earnings should improve. As investors, we can never afford to let optimism compromise our approach, but we do at least recognise that we are probably about to experience the best economic backdrop seen for several years.

This Kgori Capital Insights Outlook piece is available for public consumption and is one of a regular series of economic outlooks prepared by Kgori Capital as we strive to provide meaningful content on our economy and her performance.

General Disclaimer

All information, recommendations or opinions contained in this document are not intended to provide exhaustive treatment of any subject dealt with and must be weighed solely as one factor in any investment or other decision made by or on behalf of any user of the information contained herein. Such user should consult its own investment or financial or other advisors before making any decision. Whilst all care is taken by Kgori Capital in the preparation of the contents hereof, no warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability or fitness for any particular purpose of any such recommendation or information is given or made by Kgori Capital in any form or manner whatsoever. The information in this document is not intended to and does not constitute financial, tax, legal, investment, consulting or other professional advice, and Kgori Capital does not purport to act in any way as a financial advisor. Kgori Capital shall not be responsible and disclaims all liability for any loss, liability, damage (whether direct or consequential) of any nature whatsoever which may be suffered as a result of or which may be attributable, directly or indirectly, to the use of any information, opinion, recommendation, or service contained in or provided through this document. All portfolio performance data is calculated by Kgori Capital. Performance is analysed and computed utilising true daily weighted methodology. Where this document contains statements or information which relate to projections, forecasts or hypothetical data, users should be advised that these are predictions and that actual performance may differ markedly. Users should also be aware that short term performance can be volatile and past performance is not necessarily a good indication or guideline of future performance. As the performance of financial markets fluctuates and is not guaranteed, an investor may not get back the full amount invested.