Market Insights 2023 Q2

Market Review

The second quarter of 2023 was a strong one for domestic investments. Local equities (DCITR) continued to outperform other domestic asset classes, advancing 5.2%. Local bonds (FABI) and cash (Average MM) were up 1.7% and 1.9% respectively for the quarter.

Globally, equity markets continued to rally, led by large-cap U.S. technology companies as the perceived beneficiaries of an anticipated boom in artificial intelligence (AI). The bulk of US equity gains were made in June, amid moderating inflation and signs that the US economy remains resilient despite higher interest rates. The Federal Reserve (Fed) raised interest rates by 25 basis points (bps) in May. However, the Fed did not hike rates in June, adopting what economists have termed a “hawkish pause”.

Outlook Botswana Macro

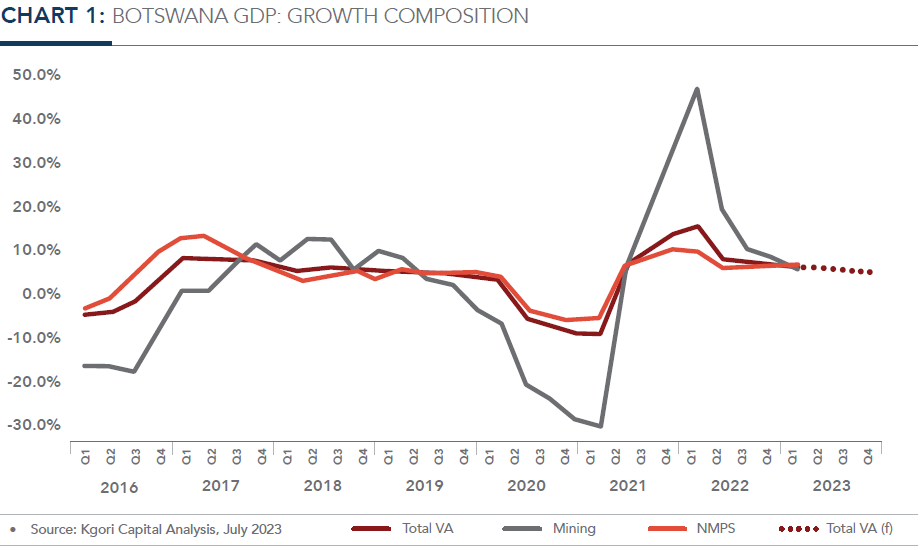

We expect GDP growth to cool down and still maintain our GDP forecast of 3.8% to 4.0% for the year 2023. The projected slowdown (compared to 2022) is mainly attributable to the Mining Sector, which is expected to experience a reduction in diamond production and a decline in average

prices for diamonds, due mainly to recession fears affecting consumer demand. However, this will be partially offset by an improved performance in the Non-Mining Private Sector (NMPS) during the year, driven by government’s less stringent fiscal policy stance.

Inflation

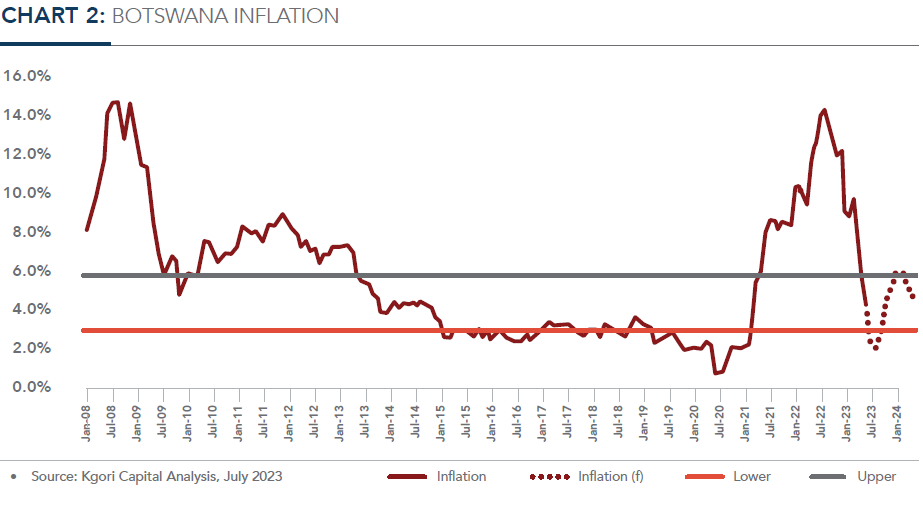

We forecast inflation to fall below the BoB’s 3% lower bound in 3Q23 due to a combination of favourable base effects and the downward adjustment of fuel prices that took place in June 2023. Inflation is expected to rise towards the end of the year as the favourable base effects begin to dissipate. We forecast inflation to rise beyond the BoB’s 6% upper bound in 1Q24, whilst the central bank project it to remain between 3-6% in the medium term.

Monetary Policy

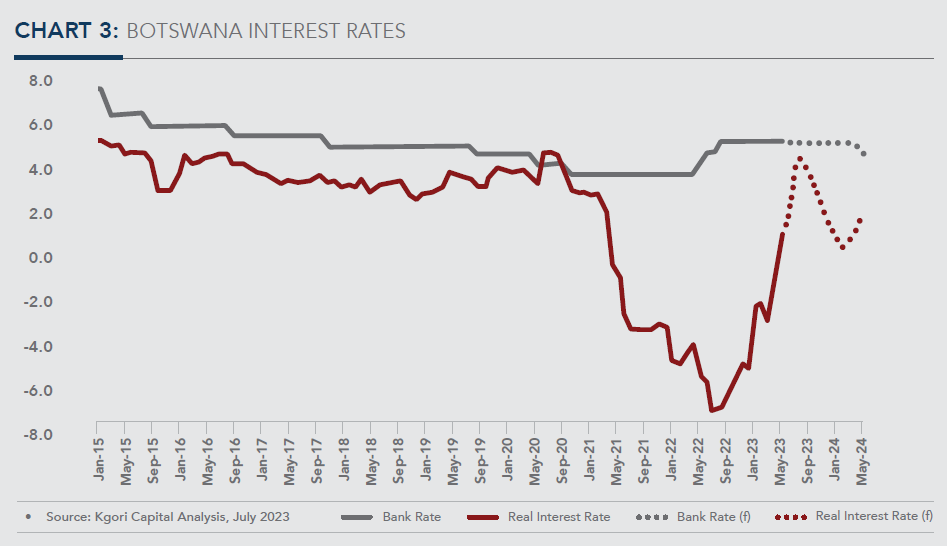

With inflation projected to remain largely under control in the medium term, we do not expect BoB to implement any changes to the MoPR in 2023. We expect a 25-50bps cut in Q2 2024.

Botswana Market View

EQUITIES

We continue to believe that the risk-reward prospects heavily favour local equities given their historically low valuations coupled with strong earnings growth expectations. Our bottom-up earnings growth estimates suggest record earnings growth this year underpinned by banking, tourism, and property sectors.

FIXED INCOME

We continue to prefer bond opportunities with investment grade corporates albeit with lesser conviction as spreads continue to tighten. Government bonds are starting to offer good value with the recent rise in yields (higher yields mean lower prices). Cash returns remain attractive as liquidity dislocations for banking sector deposits present yield enhancement opportunities.