Market Insights – Botswana Financial Markets and Macroeconomics

For the first quarter of 2023, local equities (DCITR) advanced 4.0%, continuing the positive momentum of last year.

Bonds (FABI) and cash (Average MM) were up 1.9% and 1.8% respectively for the quarter.

Market Review

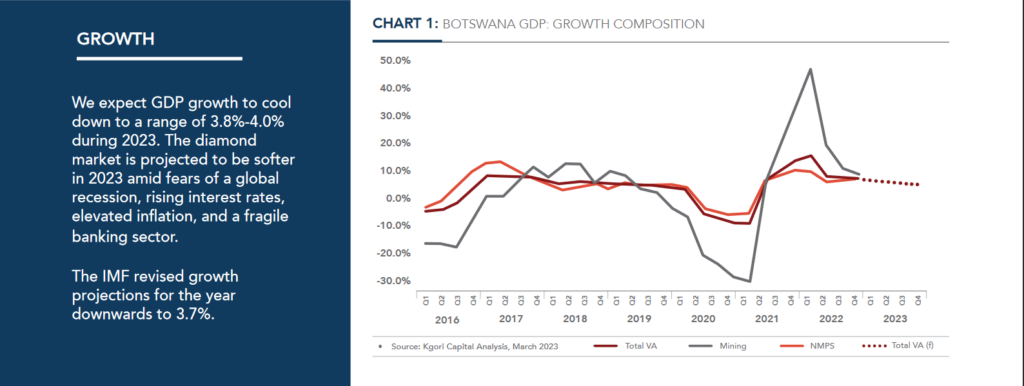

Real Gross Domestic Product (GDP) growth for 2022 printed at 5.8%, down from 11.9% in 2021, mainly attributable to the waning of base effects experienced in 2021. Debswana’s production significantly benefitted from the international sanctions against Russian exports that were due to the ongoing conflict with Ukraine. Consequently, the Mining sector expanded by 7.5% during the year, positively contributing to a GDP print that exceeded expectations, albeit being lower year-on-year (y/y) compared to the prior year. The fastest growing sectors in 2022 were Diamond Traders, Manufacturing, Mining and Wholesale & Retail which recorded y/y growth of 17.6%, 8.2%, 7.5% and 5.6% respectively.

Globally, it was a good quarter from a macroeconomic standpoint. The main positives included the performance of the labour market and consumer spending in the US, China’s reopening, and Europe’s economic resilience in the face of an energy shock and marginally easier financial conditions. For the quarter, the key global equity and global bond indices, MSCI World and FTSE World Government Bond Index increased by 7.4% and 3.5% respectively in local currency terms.

OUTLOOK – BOTSWANA MACRO

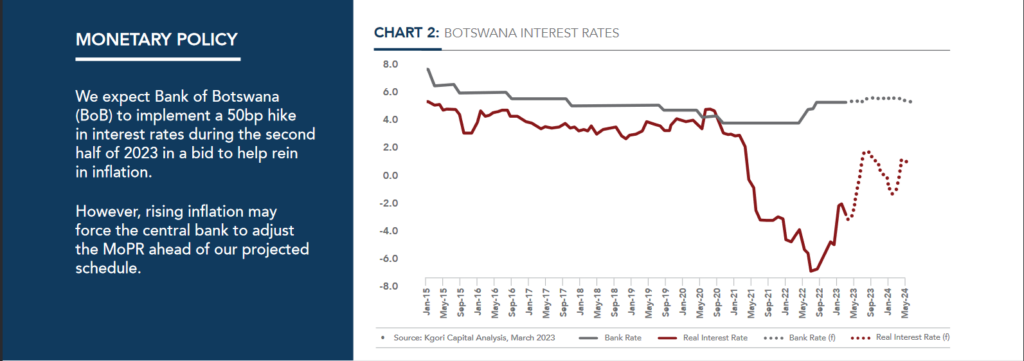

BOTSWANA INTEREST RATES

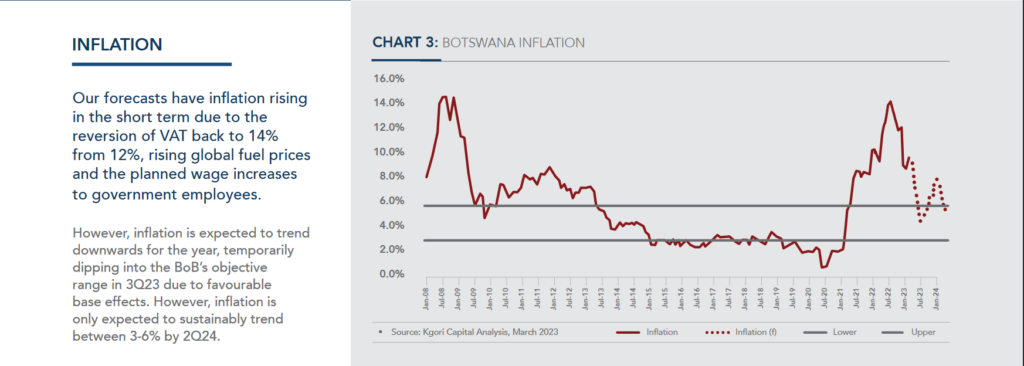

INFLATION

BOTSWANA MARKET VIEWS

Equities

We believe equities are poised for a good year in 2023. The local stock market is significantly undervalued, with positive earnings momentum and sentiment. Our bottom-up earnings growth estimates suggest record earnings growth this year underpinned by banking, tourism, and property sectors.

Fixed Income

We continue to prefer bond opportunities with investment grade corporates albeit with lesser conviction as spreads continue to tighten. Government bonds are starting to offer good value with the recent rise in yields (higher yields mean lower prices). Cash returns remain attractive as liquidity dislocations for banking sector deposits present yield enhancement opportunities.

GLOBAL MARKET VIEWS

Equities

We remain cautious on global equities. For developed market (DM) equities, our focus remains on higher-quality companies capable of preserving their margins. We adopt a more cautious stance on broader US stocks, given current overvaluation and upcoming tightening in credit and risk aversion by banks, as well as the Fed’s balance sheet reversing its current rise and resuming a steady, long-

lasting decline. We remain constructive on emerging market (EM) equities, especially Chinese equities.

Fixed Income

We believe Asia high yield is currently an attractive means to earning higher carry with very low duration. Relative to US high yield, Asia HY offers less breadth, yet more spread with declining, instead of rising, credit issues.

Commodities

Commodities find themselves caught in conflicting cross currents, making their future trajectory uncertain. On one hand, the accelerating domestic growth in China offers a positive outlook. On the other hand, our concerns regarding a potential recession in the US and Europe dampen the prospects for broad commodities. As such, we see no strong catalyst for commodities to continue to rise.

Download as PDF ( Kgori Market Insights – Botswana Financial Markets and Macroeconomics Q1 2023)