Market Insights 2023 Q3

For the first quarter of 2023, local equities (DCITR) advanced 4.0%, continuing the positive momentum of last year.

Bonds (FABI) and cash (Average MM) were up 1.9% and 1.8% respectively for the quarter.

Market Review

In the third quarter, local investments continued to perform well. Domestic stocks went up by 7.5% in price, and local bonds (FABI) and cash (Average MM) increased by 2.0% and 1.9%, respectively, for the quarter.

However, global stock markets were volatile in Q3 following a strong performance in the first half of the year. In the US, the rise in policy rates in July 2023 and a credit downgrade in August posed challenges for risk assets. The IT sector, which includes big names like Apple, Microsoft, Alphabet, Amazon, Tesla, Nvidia, and Meta, suffered losses

Eurozone stocks also declined in Q3 due to concerns about the impact of rising interest rates on economic growth. The consumer discretionary sector saw significant declines, driven by worries about the effects of higher interest rates on disposable income. The European Central Bank (ECB) raised interest rates in July and September, signalling that these might be the final hikes as economic activity slowed down.

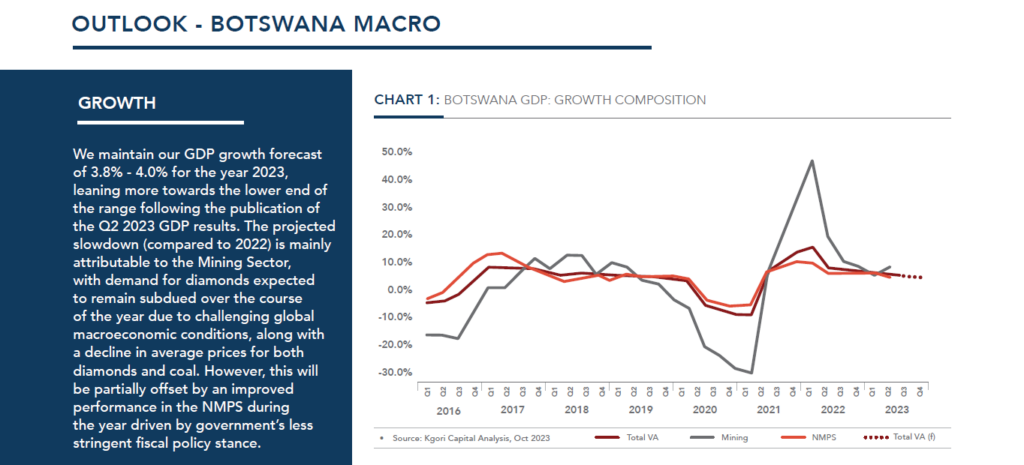

OUTLOOK – BOTSWANA MACRO

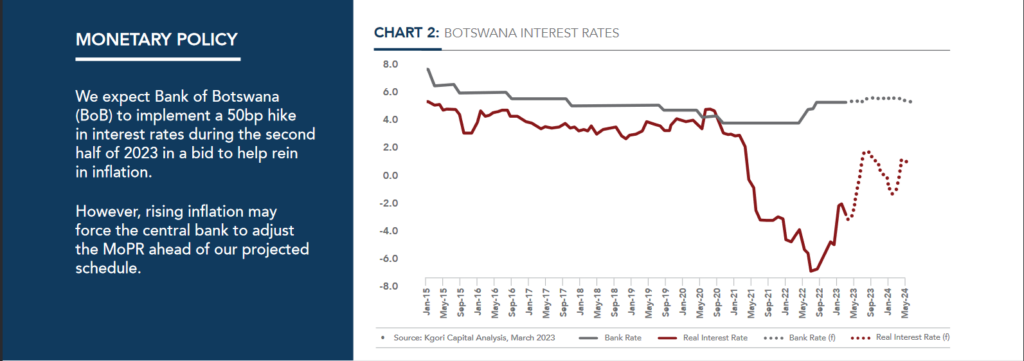

BOTSWANA INTEREST RATES

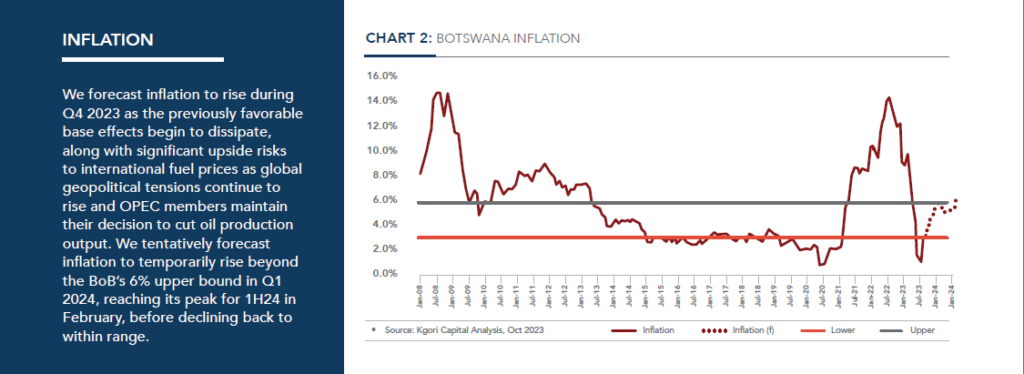

INFLATION

BOTSWANA MARKET VIEWS

Equities

We continue to believe that the risk-reward prospects heavily favour local equities given their historically low valuations coupled with strong earnings growth expectations. Our bottom-up earnings growth estimates suggest record earnings growth this year underpinned by banking, tourism, and property sectors.

Fixed Income

We still favour bonds from investment-grade corporate issuers, although our confidence in them has slightly decreased as spreads continue to narrow. Government bonds are becoming more appealing due to the recent increase in yields (higher yields result in lower bond prices). Cash returns continue to be attractive, especially as disruptions in the banking sector deposits offer opportunities to enhance yields.

GLOBAL MARKET VIEWS

Equities

Despite the third-quarter volatility in 2023, global equities have consistently exceeded our expectations for this year. As the economy shows signs of slowing down, we anticipate that the global healthcare sector will stand out as it is likely to be the primary beneficiary of an aging population. Additionally, we anticipate robust performance in the Japanese banking sector, driven by the Bank

of Japan’s gradual reduction of yield control measures.

Fixed Income

Monetary Policy Easing in Brazil is expected to be the main benefactor for Brazil Short Duration Government Bonds. Asian high-yield credit presents an attractive opportunity due to its combination of substantial yield and limited duration risk. When compared to the high-yield market in the United States, Asian high yield offers more significant spreads and shows improving credit fundamentals. This makes it a compelling option for fixed-income investors looking to diversify their portfolios with assets that have the potential for spread tightening and can complement their core developed market holdings.

Commodities

“Green commodities” show a wide range of expected returns. Aluminium looks attractive, whereas lithium seems unattractive. The divergence in supply growth is the key factor, with less-appealing markets experiencing a glut of supply from previous investments.

Download as PDF ( Kgori Market Insights – Botswana Financial Markets and Macroeconomics Q1 2023)