Market Insights: Revisiting Ndp 11

The Ministry of Finance and Economic Development released the 2020 Budget Strategy Paper in October. The conclusion of the current fiscal year, FY19/20 marks the end of the first half of the eleventh National Development Plan (“NDP 11”).

For some background, NDP 11 is the first medium-term plan towards the implementation of Botswana’s second vision -Vision 2036. The Plan will run from the 1st of April 2017 to the 31st of March 2023.

Government has utilised this moment to review the trajectory of the fiscus against NDP11 and take measures to re-align the second half of NDP11 to budget expectations.

NDP 11: REVIEW OF FIRST HALF PERFORMANCE

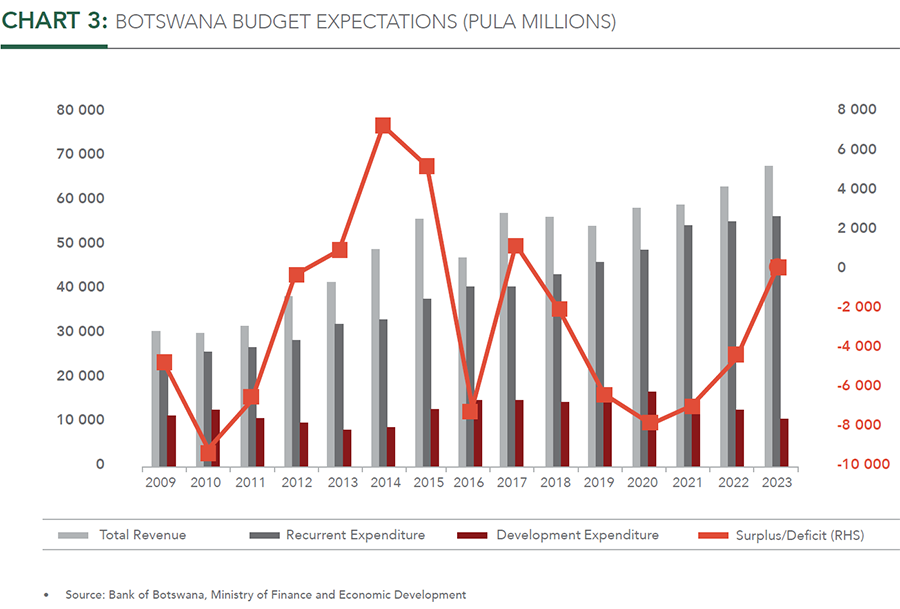

The Government is expected to underspend actual development spending by P10.9bnin the first three years of NDP11 due to ballooning recurrent expenditure from a higher Government wage bill, coupled with lower Mineral revenues to cushion the increase in the public sector wage bill. This trend is expected to continue into the second half of NDP11. Development expenditure will undershoot second half NDP11 targets by P7.9bn, bringing the cumulative development expenditure shortfall to a staggering P18.7bn for NDP11.

This does not bode well for future economic growth as development spending remains akey driver for stimulating domestic economic activity mainly from spending on physical infrastructural developments.

NDP 11: EXPECTED SECOND HALF PERFORMANCE

NDP11 forecasts a second half surplus ofP19.5bn but the 2020 BSP forecasts a second half deficit of P10.9bn. Thus, the main focus for Government in the second half of NDP11 is cost rationalisation on the recurrent expenditure side and implementation of fewer development projects.

The main costrationalisation efforts are a moratorium on new parastatals, refraining from building new offices and rationalisation of the civil service. This will include freezing on manpower positions in FY21 and encouragement of Ministries and Agencies to rationalise their existing establishments. The reduced development expenditure budget will be utilised on high return projects.

The 2020/2021 deficits will be funded by a combination of borrowing, mainly from the domestic market, and drawing down on Government cash balances held at the Central Bank. Government cash balancesare seen as a cushion for unforeseen future development and, hence, the deficit is likely to be predominantly funded by domestic borrowing.

THE BOTTOM LINE

Government has acknowledged that something had to be done to arrest further deterioration of the fiscus and has embarked on a cost minimisation process in order to achieve a balanced Budget by the financial year 2022/2023.

The successful implementation of the 2020/2021 Budget and future Budgets will rest on the ability of Government to successfully implement highreturn projects within time and budget, limit cost leakage and support business in order to boost Customs & Excise revenue.

Click here to read full article

Kwabena Antwi

Portfolio Manager