Market Insights: Local Commentary – Fixed Income and Macroeconomics

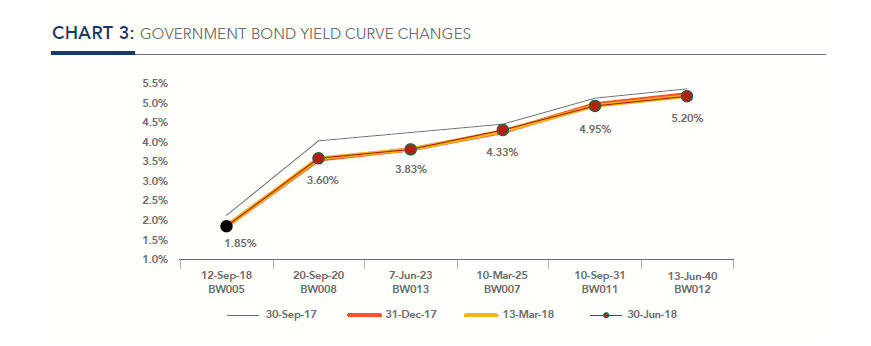

Domestic bond returns were relatively stable as the FABI returned 1.2% for the quarter.The Government bond yield curve remained largely unchanged. The only movement was theBW007 maturing in 2025 which rose by 3bps.

The June Government Bond and Treasury Bill Auction saw bids of P1,736mn slightly higher than the P1,705mn of bids received in the March auction. The issuance was oversubscribed byP586mn. The most demanded instrument were T-Bills, which were over subscribed by P250mn.

Inflation continues to stay rooted at the bottom end of the Bank of Botswana’s 3-6%objective range; June inflation was 3.1% y/y.Inflation has declined due to a pullback in food inflation driven by plummeting Bread &Cereals inflation. The main driver of inflation has been increases in administered prices.Excluding administered prices core inflation was at 1.8% in June.

Going forward, we expect inflation to increase to the mid-range of the Bank of Botswana’s 3-6% objective range with risks balanced. The main upside risk relates to increases in administered prices such as water and fuel which may drive inflation further up. The main risk to the downside emanates from continued tepid domestic demand. We expect the Bank to maintain its current accommodative monetary policy stance in order to support economic growth.

The Monetary Policy Committee (MPC) met once during the quarter, on 19 June. The MPC kept the benchmark rate unchanged at 5.0%, stating that the current state of the economy and the outlook for both domestic and external economic activity suggested that the prevailing monetary policy stance is consistent with maintaining inflation within the Banks 3-6% objective range.

The Bank of Botswana released the results of its Business Expectation Survey for the month of March 2018. The results are encouraging with increases in sentiment around current and future business conditions. 58% of business are positive of current economic conditions, a 14% increase from the 46% recorded in September 2017.Businesses are also optimistic about the future with 79% of businesses confident of trading conditions in the next 12 months, an increase of 15% from September 2017.

December 2017 formal employment statistics were released by Statistics Botswana. The number of people formally employed increased by 1,145 (0.3%) q/q to 410,392.The bulk of employment was added by Government, a total of 860 jobs. Average monthly wages also increased, growing by2.1% q/q to P6,216.

We expect 2018 to be another year of stable growth; we forecast growth of 4.0% for 2018following a 4.8% y/y print for the first quarter.Our full year estimate is below the Ministry of Finance and Economic Development’s forecast of 5.3%. The lower growth expectation is on account of more moderate expectations of trade, hotels and restaurants.

Mining is expected to continue its recovery due to resurgence in diamond activity.Diamond demand is largely driven by retail diamond sales in developed markets.Developed market consumers are growing in confidence due to a continued rise in global equity markets, loose monetary policy and US tax reforms. We have seen early signs of this playing out, with Q1 2018Mining Production Index growing by 12.7%y/y. Diamond production contributed 11.2percentage points of the growth.

We do not expect the Bank of Botswana to reduce rates further. This is unless inflation continues to trend below its objective range, and this is on account of increases in administered prices.

We have moderately reduced our 2018 year end inflation forecast to 3.7% from 4.2%on account of subdued domestic demand and low food inflation. The key upside risk remains rising administered prices which we expect to increase during the year. Simply put,we do not see any material upside pressures to inflation in the short-to-medium term.

Click here to download Kgori Capital Insights for 2018

Author: Kwabena Antwi – Investment Analyst