Market Insights: Local Commentary

Fixed Income And Macro

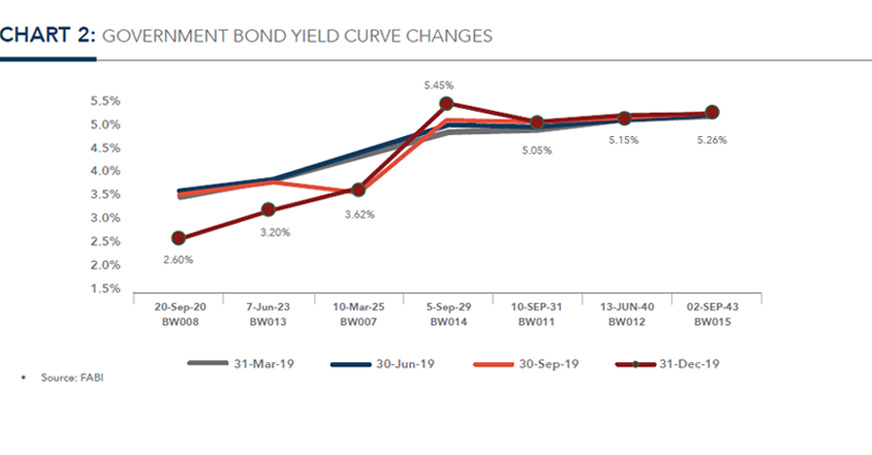

The FABI returned 1.2% for the quarter. The Government Bond yield steepened as the short end fell on account of the Bank of Botswana’s (BoB) rate cut on August29, 2019. The yield on BW007, BW014 and BW011 declined by 4bps, 27bps and 5bpsrespectively. The BW012 and BW015 rose by 5bps and 2bps respectively.

The November Government Bond and Treasury Bill Auction saw bids of P2 480mn, higher than the P2129mn of bids received in the August auction. The issuance was oversubscribed by P1 230mn. The most demanded instrument was the BW014 Government bond, oversubscribed by P770mn.

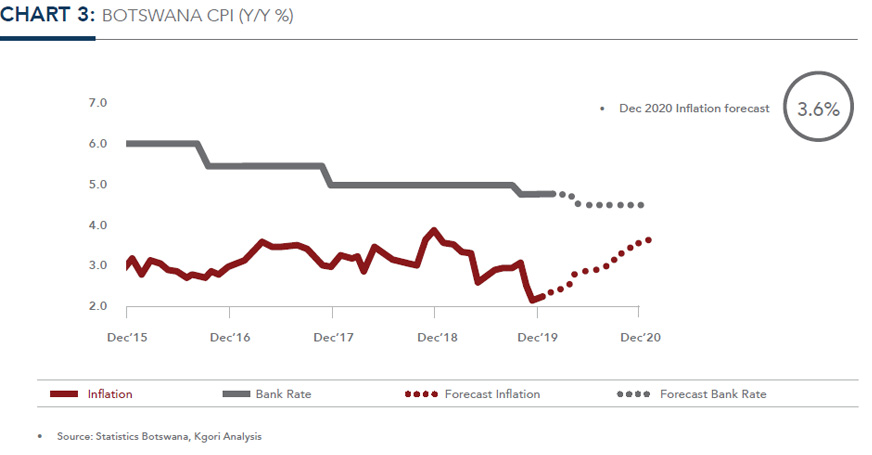

Inflation trended below the lower bound of the BoB’s 3-6%objective range. The December 2019 inflation came in at 2.2%,while inflation remained tepid due to minimal food inflation pressures and declining transport inflation. Transport inflation stood at 1.3% in December 2019 versus 10.0% in December 2018.The lack of administered price increases in 2019 has also held back inflation. Inflation, excluding administered prices, was 2.5%in December, 0.3% higher than headline inflation.

Looking ahead, we expect inflation to remain below the mid-point of the Bank of Botswana’s 3%- 6% objective range with risks balanced. The main upside risk relates to increases in administered prices such as fuel, water and electricity as well as resurgent food inflation driven by dry weather conditions. The main risk to the downside emanates from continued lacklustre domestic demand.

The Monetary Policy Committee (MPC) during the quarter on 31 October and5 December. The MPC left its benchmark interest rate unchanged at 4.75% due to the current Monetary Policy stance being consistent with maintaining inflation within its 3%-6% objective range. The Central Bank expects inflation to remain subdued in the medium term and revert to within its3%-6% objective range in Q2 2020. The Central Bank’s positive inflation outlook in the medium term is driven by subdued domestic demand pressures and modest increases in foreign prices.

We expect the Bank to proceed with another rate cut within the first half of 2020 in order support economic growth. The August 2019rate cut by the BoB was effected in order to support growth now that the Bank feels expectations of stable and low inflation are well anchored. The Gross Domestic Product(GDP) growth is expected to decelerate in2019 which increases the prospect of another 25bps cut.

The latest GDP statistics released indicated that the economy grew 3.7% in Q319 on a12 month rolling basis, down from the 5.0%growth recorded in Q318. The deceleration in growth can be attributed to the slowdown in Mining, which slowed from 4.1% in Q318to 1.6% in Q319, and Trade, Hotels &Restaurants, which slowed from 7.8% in Q318to 4.2% in Q319.

For 2020, we forecast another year of moderate growth for the Botswana economy. We expect the economy to expand by 3.5% for the fiscal year 2019and 4.0% in 2020 due to stabilisation in the diamond market.

Q3 2019 Mining Production statistics were released by Statistics Botswana and highlight that the overall mining production grew-0.4% y/y. The main detractor was diamond production which declined by 0.7% y/y due to cautiousness on account of weaker trading conditions.

The latest Trade statistics indicated a deficit ofP3.4bn in October 2019. Exports decreased by 49.3% m/m (P2.1bn) driven by a 54.2%m/m (P2.0bn) drop in diamond exports while imports increased by 3.8% m/m (P0.2bn) due to a P0.1bn increase in diamond imports. The statistics also show that on a 12 month rolling basis the trade balance sat at a P0.9bn deficit.

The Ministry of Finance, in conjunction with the Bank of Botswana, conducted a review of the Pula basket in November 2018. They maintained the current Pula basket weights at 45% ZAR and 55% SDR and implemented a 1.51% downward rate of crawl per annum effective 1 January, 2020. The rate of crawl was adjusted from an upward rate of 0.30%(appreciation) for 2019. The change in crawl suggests expectations for Botswana inflation to be moderately higher than that of our trading partners. We expect this to have little impact on the Pula outlook as the domestic currency will remain mostly linked to South African Rand and US Dollar movements. The Rand remains at risk to global investor sentiment swings.

We continue to monitor with a keen eye all developments, performances and trends.

Click here to read full article

Kwabena Antwi

Portfolio Manager