Market Insights: Global Market Review

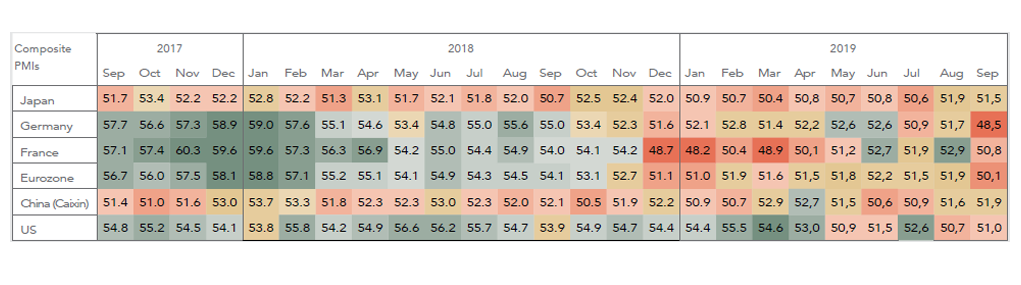

Globally, broad economic trends weighed somewhat on market performance in the third quarter, with expectations falling inthe US and China, and growth slowing very materially in Europe.

Central banks quickly took the deceleration on board; the Federal Reserve and the People’s Bank of China both lowered their headline rates, while the ECB took its base rate to are cord low of -0.5% and removed the end date on its monthly bond-purchase programme.

During the third quarter, global equities rose 0.1%. Within developed markets, US equities rose 1.2%; European equities rallied 2.8%; and Japanese equities strengthened 2.3%. Emerging market equities fell 4.2%,the second quarter of declines, anchored by losses in Chinese equities.

One market that took a major fall was the Hang Seng. The Hong Kong protests, which began on the 9th of June, continued through the period, as Beijing struggled to employits usual approach in a territory with an independent judiciary and press. The protests weakened Hong Kong’s economy, in part dueto labour strikes and declining retail sales, but also on falling investment from the mainland.

Yields on 10-year US Treasuries fell morethan 30bps, as markets started pricing in a higher likelihood of rate cuts from the Fed. In Europe, yields on 10-year German bond yields also declined to record low levels of-0.57%. Japanese Government bonds also fell deeper into negative territory, endingthe third quarter at -0.21%. Within creditmarkets, US corporate bonds continued to rally during the quarter; high grade bonds were up 3% and high yield bonds were up 1.3%. Emerging market sovereign bonds, measured in US Dollars, increased 1.5% in the third quarter.

The US Dollar strengthened 3.4% against its major trading partners. The Euro retreated -4.2% and ended the quarter at 1.09 against the greenback.

The Japanese Yen, however, rose by 2.8% and ended the third quartertrading at 108.08 against the US Dollar.Emerging market currencies sold off againstthe US Dollar, led by notable losses in theBrazilian Real, Chinese Yuan, and South African Rand.

Within equities, the rotation away from defensives towards the more economically-sensitive securities(cyclicals) is underway with more room to run.

Intermediate term (9-18 months) valuation still suggests there is much further, however, to go. Within fixed income, we expect that the US yield curve inversion will be short-lived as short term rates, controlled by the Fed fall, while the long-end remains well anchored. The risk/return trade-offf or core fixed income remains unattractive.

World growth should remain on a moderate trend next year, still with downside risks; uncertainties on trade, Brexit and a number of domestic political situations in several countries weigh on confidence and investment decisions. Against this backdrop, central banks were obliged to adopt a more accommodative stance.

Click here to read full article

Alphonse Ndzinge

Managing Director