Market Insights: Global Market Review

Market Review

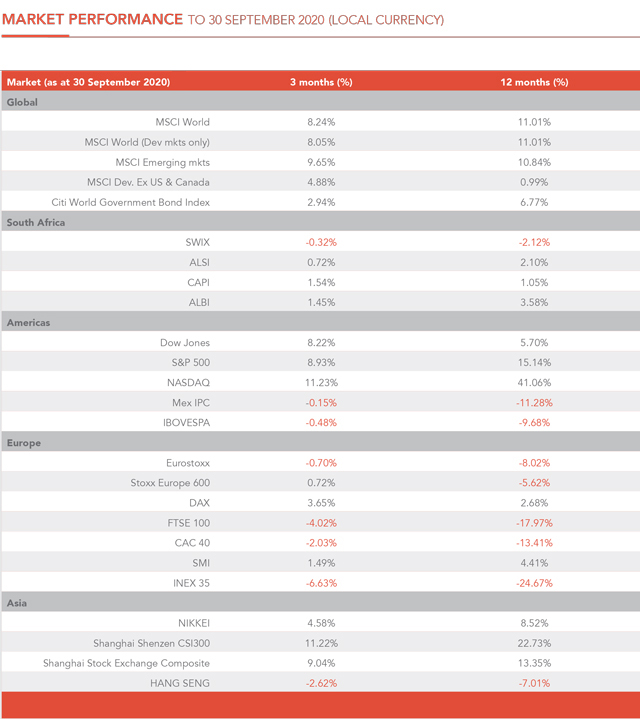

The COVID-19 pandemic continued to dominate global headlines inthe third quarter (Q3) of 2020, with many countries battling a secondwave of infections amid the ongoing re-opening of economies. Q3 2020market performance followed a similar trend as Q2 2020 with local assetssignificantly underperforming global markets.

Locally, equities lost 1.2% as the COVID-19pandemic and consequent containment measures severely weakened investor sentiment across the board. Bonds returned1.1% for the period driven by coupon returns as yields were mostly unchanged (meaning prices were flat).

Globally, the rebound in global economies gathered momentum in Q3 2020, driving the MSCI All Country World Index (ACWI) totally 8.3%, bringing its year to date return to1.8%. Share prices rose largely on the back of expectations of ongoing government and central bank policy support. These will continue to drive the global recovery coupled with some promising developments on the COVID-19pandemic vaccine front.

In terms of geography, US stocks performed well, with the bellwether S&P 500 Index climbing a further 9.6% for the quarter. Share markets were also higher in China (+12.6%)and Japan (+4.6%) but fell in the UK (-4.0%)and Europe (-0.7%). For the top performer China, domestic Q2 GDP growth rebounded to 3.2% year-on-year, after a fall of -6.8% inQ1 2020, and was stronger than expected.Q2 2020 earnings results were also ahead of expectations, notably in the e-commerce sector.

Government bond yields were mixed. The US10-year yield finished at 0.68%, three basis points (bps) higher, with the UK 10-year yield six points higher at 0.23%. Additionally, the German 10-year yield fell by 7bps, finishing at -0.52%, while Italy’s yield fell by 39bps and Spain’s by 22bps.

Souce: Bloomberg

Click here to read full article