Market Insights – Botswana Fixed Income and Macroeconomics

We expect inflation to now average 12.4% in 2022 compared to 7.7% previously.

The economy grew 13.0% y/y on a 12 month rolling basis (LTM) in 1Q 2022 driven by Mining, Diamond Traders and Wholesale and Retail.

Market Review

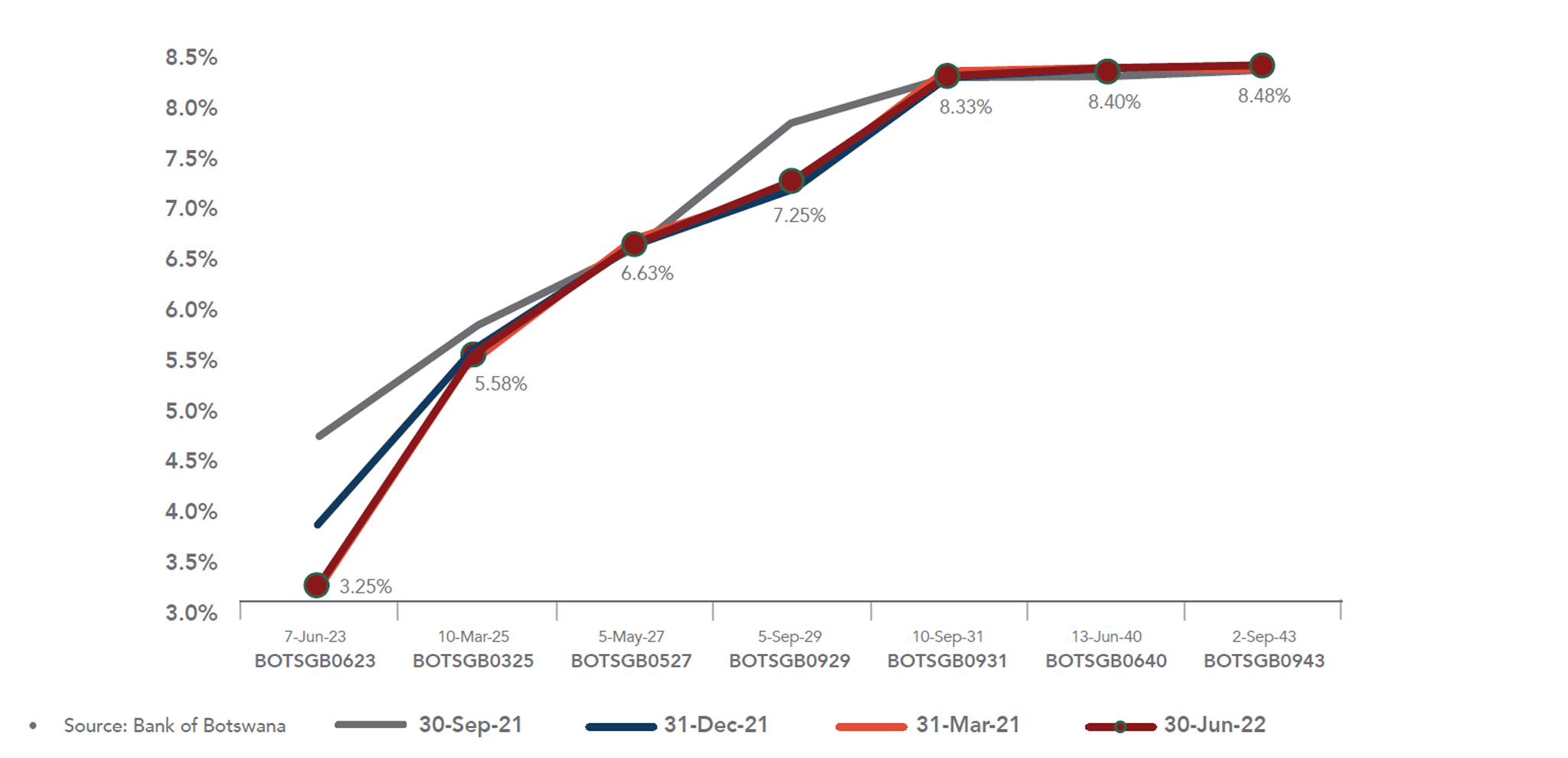

The FABI returned 1.6% for the quarter mainly attributable to coupon returns as prices in general, remained stable. Overall, the Government Bond par curve continued to steepen as the short-to-mid section of the yield curve declined once again whilst the longer end of the yield curve remained stable.

Chart 1:

GOVERNMENT BOND YIELD CURVE CHANGES

There were three Government bond auctions held during the quarter wherein P4.5bn of bonds and T-Bills were offered. Demand was moderate with P5.2bn of bids received. Auctions continued to be under allotted and the allotment ratio decreased to 56.1% from 70.6% in Q1 2022. The bulk of the allotment was at the short end of the curve where P1.8bn (62.4% of total allotment) of T-Bills were issued. Bond yields remained stable but there is still more supply pressure expected as Government plans to run a deficit budget for the 2023 financial year, which will be partly funded by local bond issuance.

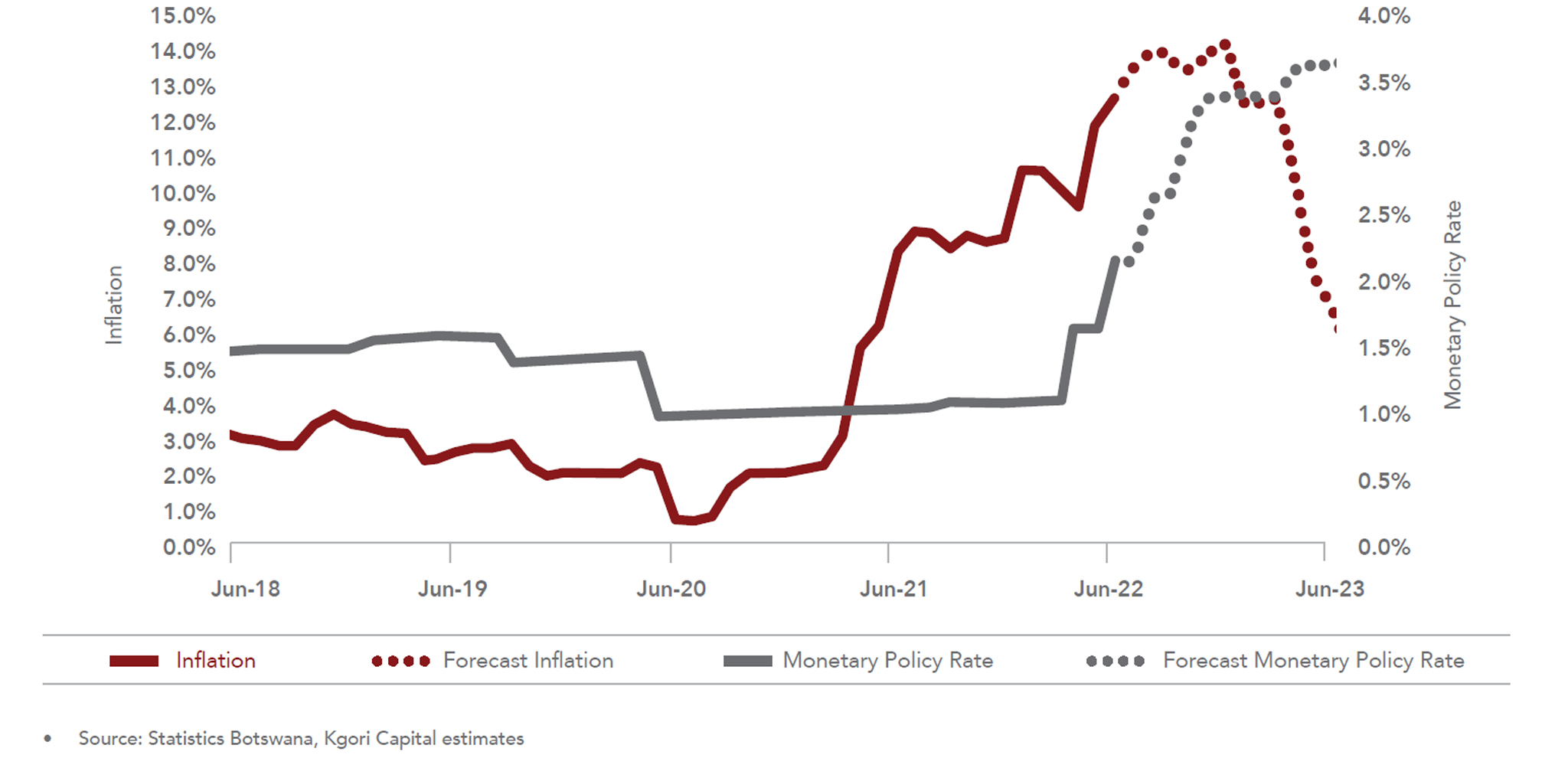

Inflation continued to trend above the Bank of Botswana’s (BoB) 3-6% objective range with June 2022 inflation coming in at 12.7%, accelerating 0.8% from the 11.9% registered in May 2022. The increase was driven by rising Transport (3.1% m/m, 35.0% y/y) and Food (1.8% m/m, 9.6% y/y) inflation. We have again increased our inflation expectations for 2022 on account of expected high Transport and Food inflation. We now expect inflation to only print within the BoB’s objective range in Q4 2023. We expect inflation to now average 12.4% in 2022 from 7.7% previously.

The BoB Monetary Policy Committee (MPC) met twice during the quarter on 28 April and 16 June 2022. During its April meeting, the MPC implemented reforms to its monetary policy framework that were previously announced in the BoB’s 2022 Monetary Policy Statement.

The Bank Rate has been replaced by the Monetary Policy Rate (MoPR), which is the yield on the 7-Day BoBC, as the new policy signalling rate. The MPC then increased the MoPR by 0.51bps to 1.65% from 1.14%. The MPC again increased the MoPR by 50bps at its 16 June meeting. The MPC cited persistently high inflation as the reason for increasing rates.

A trade deficit of P0.3bn was recorded for the month of April 2022. On a Last Twelve Months (LTM) basis the trade deficit stood at P10.1bn in April 2022; a contraction of P11.2bn versus the P21.2bn LTM deficit recorded in April 2021. The main driver behind the improvement in the deficit was the continued normalisation in diamond trade which registered a surplus of P4.0bn in April 2022 and a much improved LTM trade surplus of P43.4bn versus the P27.9bn recorded in April 2021.

April 2022 credit growth accelerated to 6.6% from 6.0% y/y in March 2021. Household credit growth moderated by 0.4% to 5.6% y/y in April owing to a general deceleration in growth across segements. Business credit growth on the other hand increased by 2.7% to 8.5% in April driven by upsurge in lending to Real Estate, Finance and Trade sectors.

The economy grew 6.5% q/q and 13.0% y/y on a 12 month rolling basis (LTM) in 1Q 2022 driven by Mining (16.4% q/q, 42.0% LTM y/y), Diamond Traders (44.4% q/q, 30.1% LTM y/y) and Wholesale and Retail (6.1% q/q, 12.4% LTM y/y). Growth was generally positive across all segments as the economy continued to benefit from an easing of Covid-19 restrictions.

The BoB released the results of its March 2022 Business Expectations Survey (BES). Both domestic and export oriented businesses noted a decline in business confidence. Overall businesses expect lower sales, inventories, profit and capacity utilisation versus the December 2021 survey. Businesses also expect tighter access to credit across all markets and higher cost pressures in Q2 2022 versus Q1 2022.

The BoB released its April 2022 Monetary Policy Report where it highlighted that it has increased its inflation expectations due to rising commodity and domestic fuel prices as well as higher inflation from trading partners. Risks to inflation are skewed to the upside. These risks include the potential increase in commodity prices and the persistence of global supply chain bottlenecks. Overall the BoB concluded that the current state of the economy and the outlook for both domestic and external economic activity provide scope for maintenance of an accomodative monetary policy to support durable recovery and economic activity.

The Financial Stability Council (FSC), made up of BoB, Ministry of Finance and Econcomic Development and the Non-Bank Financial Institutions Regulatory Authority, released the May 2022 Financial Stability Report. The FSC concluded that whilst Botswana’s financial system remains resilient and continues to perform its expected function of financing other sectors of the economy, the existing macro-financial interlinkages between banks, non-bank financial institutions, the non-financial sector and the external sector remain extensive and strong and pose a risk of contagion. Overall vulnerabilities that could elevate risks to financial stability have moderated following the opening of the economy.

Outlook

We have increased our 2022 growth expectation to 6.4% from 3.4% on the back of buoyant Mining activity.

Diamond sales have continued to maintain their robust momentum in 2022 which we expect should bolster production.

INTEREST RATES

We expect the BoB to implement a cumulative 125bps increase in rates as it battles to contain inflation and maintain interest differentials with trading partners and global central banks.

INFLATION

We expect inflation to remain elevated and trend above the BoB’s objective range in 2022 and fall within the range in Q4 2023 driven by base effects.

Chart 2:

INFLATION EXPECTATIONS

Download as PDF (Kgori Domestic Fixed Income and Macro Commentary Q2 2022)