Market Insights: Botswana Fixed Income And Macroeconomics

- We have increased our 2021 GDP growth expectation by 1.0% to 9.9%.

- We expect the BoB to implement at least one 25bps rate hike in 2022 as it walks the tightrope between rising inflation and supporting economic growth.

- We expect average inflation of 6.6% in 2022 largely driven by Transport and Housing inflation.

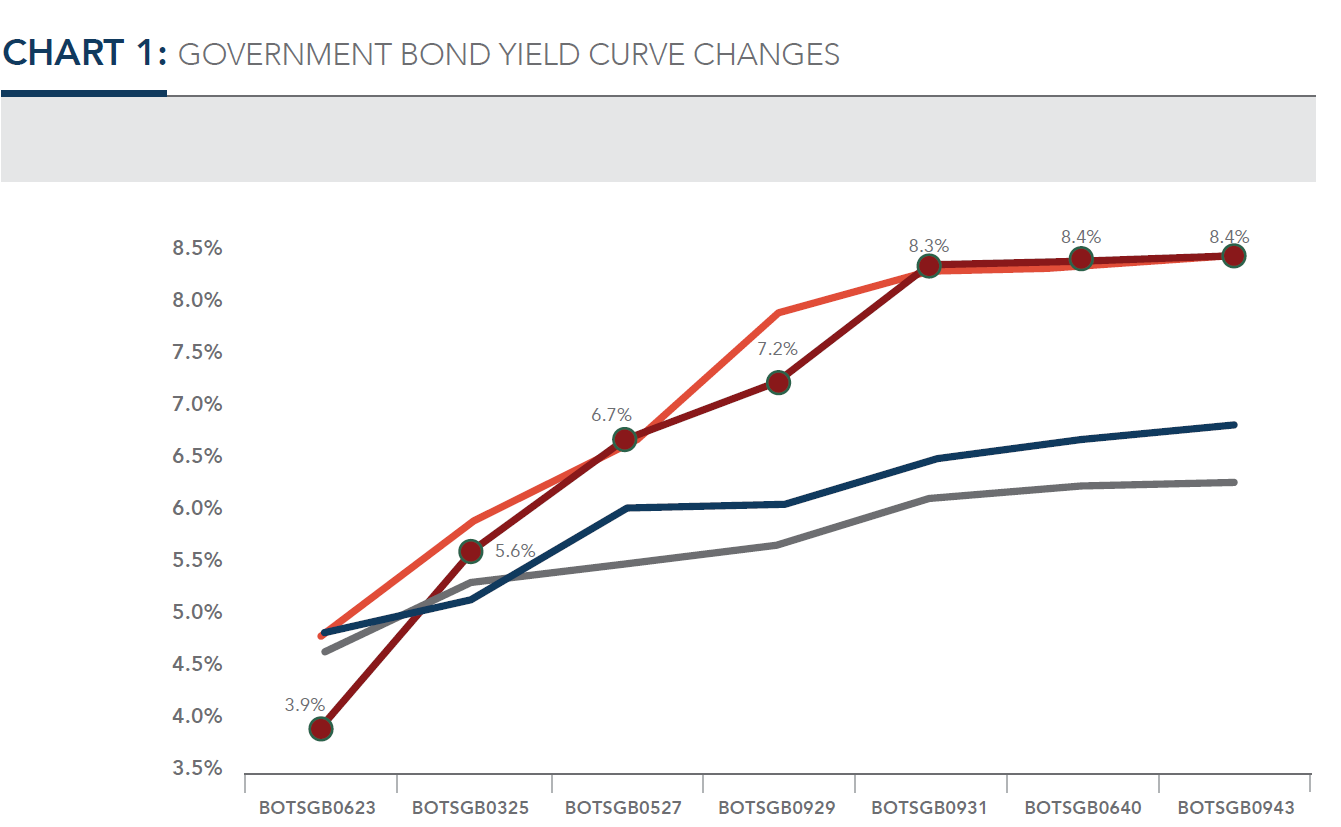

The FABI returned 1.9% for the quarter mainly attributable to coupon returns as prices, in general, remained stable. The short-to-mid section of the yield curve declined whilst the longer end of the yield curve remained largely unchanged.

There were three Government bond auctions held during the quarter where P4.9bn of bonds and T-Bills were offered. There was low to moderate demand with P5.8bn of bids received, however, in a similar manner to Q3 2021’s auctions, they were under allotted with an allotment ratio (allotment divided by securities on offer) of 57.4%. The bulk of the allotment was at the short end of the curve where P2.3bn (81.2% of total allotment) of T-Bills were issued. The question still remains whether the Government can plug the funding gap caused by the continued under allocation of domestic issuances, with external loans. We hope to see this question addressed in Q1 2022 when the Minister of Finance presents the 2022 Budget Speech.

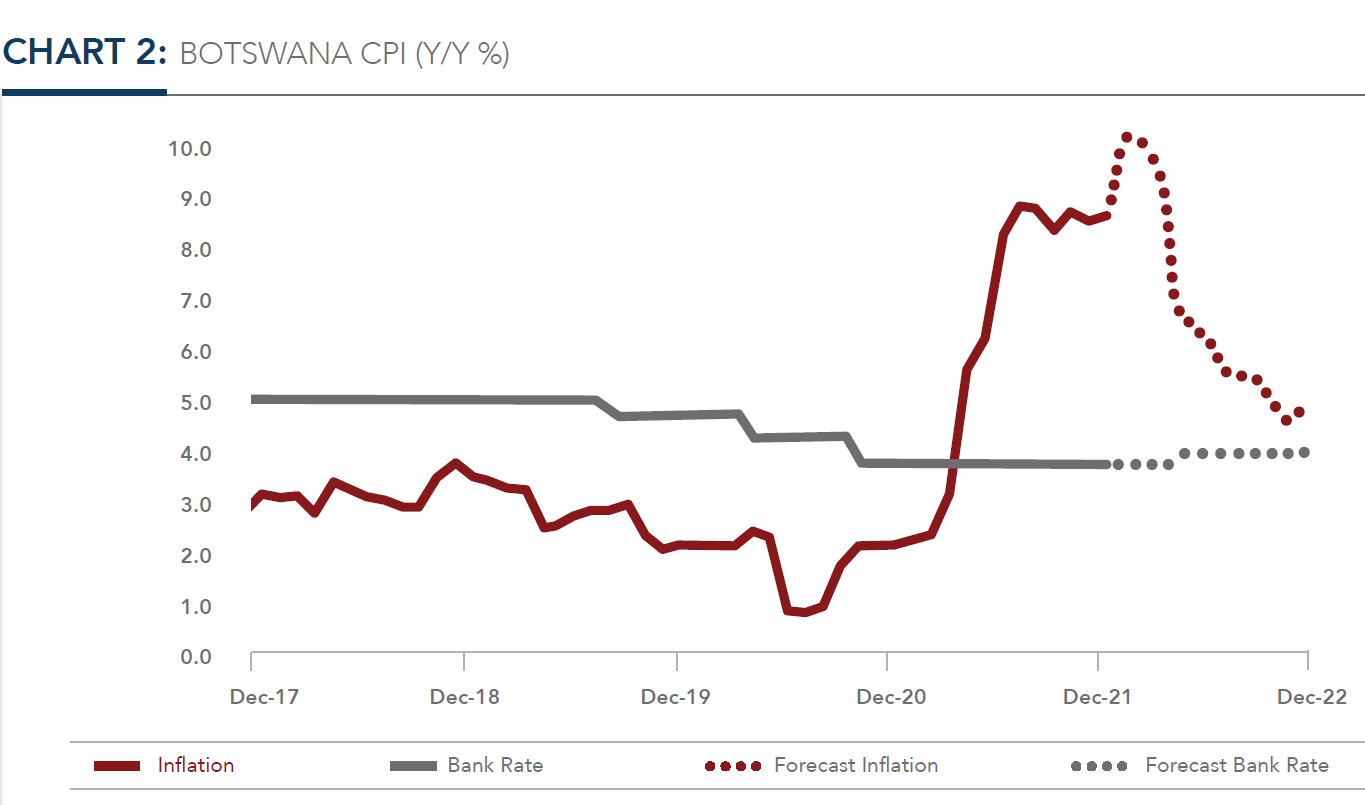

Inflation continued to trend above the Bank of Botswana’s (BoB) 3%-6% objective range with December 2021 inflation coming in at 8.7%, accelerating 0.1% from the 8.6% registered in November 2021. The increase was driven by a pickup in Food inflation which increased by 0.5% to 7.2% y/y in December. Inflation averaged 6.7% in 2021 due to high Transport, Housing and Food inflation which averaged 12.3%, 7.7% and 6.0% respectively. We expect inflation to accelerate further in January 2022 due to the December 2021 ~15% increase in pump prices, which appears not to have been factored into December 2021 transport inflation. From there we expect inflation to decelerate but continue to trend above the BoB’s objective range until Q3 2022. We expect average inflation of 6.6% in 2022 largely driven by Transport and Housing inflation.

The BoB Monetary Policy Committee (MPC) met twice during the quarter on 21 October and 2 December 2021. The MPC maintained the Bank Rate at 3.75% despite inflation continuing to trend above the upper bound of its objective range.

The MPC maintained its view that the current pickup in inflation is transitory (due to factors such as the increase in VAT and fuel pump prices) and hence maintained its accommodative position. The MPC increased its inflation expectations as it now expects inflation to fall within its 3-6% objective range in Q3 2022 from Q2 2022 previously. It also increased its 2022 average inflation expectation to 7.0% from 6.1% previously.

A trade deficit of P3.8bn was recorded for the month of October 2021. On a Last Twelve Months (LTM) basis the trade deficit stood at P12.7bn in October 2021, a contraction of P12.3bn versus the P25.0bn LTM deficit recorded in October 2020. The main driver behind the improvement in the deficit was the continued normalisation in diamond trade which registered a surplus of P1.0bn in October 2021 and a much improved LTM trade surplus of P39.0bn versus the P20.7bn recorded in October 2020.

The economy expanded by 3.4% q/q in Q3 2021 driven by the Mining and Diamond Trade sectors, which registered growth of 10.3% q/q and 95.3% q/q respectively. On an LTM basis the economy grew 8.6% y/y. Growth was registered in most sectors with the main drivers of annual growth, again, being Mining (15.6% y/y) and Diamond Traders (71.8% y/y). The only sectors which registered negative growth on an LTM basis were Agriculture (-4.9% y/y) and Accommodation (-8.7% y/y). Following the release of strong Q3 2021 growth figures, we expect annual growth in 2021 to close off at 9.9%, 0.2% higher than Government forecasts, driven by resurgent Mining and Diamond Trading sectors. We expect growth to significantly moderate in 2022 to 3.4% as the business environment returns to normality.

The BoB released its December 2021 Monetary Policy Report (MPR), where it stated that monetary policy will be tighter but still accommodative in 2022 in order to support economic growth. The BoB increased its inflation expectation but still expects the upward breach of its 3-6% objective range to be short term in nature. The BoB now expects inflation to fall within its 3-6% objective range in Q3 2022 from Q2 2022 in its October 2021 MPR. The increased inflation expectation is due to the December 2021 fuel price hike, expected increases in private school fees in Q1 2022 and proposed electricity price hikes in 2022. The BoB has assessed that the risks to inflation remain tilted to the upside but sluggish economic growth should keep inflation restrained in the medium term.

In order to achieve and maintain the competitiveness of Botswana products and services in the domestic and international market, the Government maintained the Pula basket weights at 45% South African Rand and 55% IMF Special Drawing Rights (SDR). The Government also maintained the annual downward rate of crawl at 2.87% for 2022.

October 2021 credit growth moderated to 5.8% y/y from 7.4% y/y in September 2021. Household credit growth moderated by 0.7% to 7.8 y/y in October due to a deceleration in growth from “Other loans” (which includes personal loans). Business credit growth reduced by 1.1% to 3.0% in October driven by declines in lending to Real Estate, Parastatals and Transport & Communication sectors.

BoB released the results of its Q4 2021 Business Expectations Survey. Firms indicated that they were optimistic about economic activity in 2022 but cited that they expect access to credit to be tighter and costs to rise due to the second-round effects in administered prices. The main challenge to firms in general were Covid-19 related restrictions and to Manufacturing firms in particular were raw material shortages. Firms expect inflation to average 6.4% in 2021 and 5.8% in 2022. Firms also expect the economy to grow by 4% in 2021.

The Financial Stability Council (FSC), made up of BoB, the Ministry of Finance and Development and the Non-Bank Financial Institutions Regulatory Authority, released its October 2021 Financial Stability Report. The FSC assessed Botswana’s financial system as resilient with strong capital and liquidity buffers, as well as moderate profitability. Domestic credit growth remains moderate and poses minimal risk to financial stability. The removal of Botswana from the Financial Action Task Force’s grey list will boost confidence in the domestic financial system. Vulnerabilities are judged to be moderate in the short term, with the main vulnerability being sovereign in nature related to the weakened fiscal position and deteriorating balance of payments.

Outlook

GDP

We have increased our 2021 GDP growth expectation by 1.0% to 9.9% following the release of Q3 2021 figures. Growth will be driven by the resurgence in Mining and Diamond Trading activity. We expect growth to moderate to 3.4% in 2022 due to the normalisation in business activity.

We expect a strong resurgence in Mining activity in 2021 as production was severely curtailed in 2020 due to lockdowns, travel restrictions and reduced demand.

INTEREST RATES

We expect the BoB to implement at least one 25bps rate hike in 2022 as it walks the tightrope between rising inflation and supporting economic growth.

INFLATION

We expect inflation to remain elevated and trend above the BoB’s objective range in the short term and fall within the range in Q3 2022 driven by base effects.