Market Insights: Botswana Fixed Income And Macroeconomics

- We have increased our 2021 GDP growth expectation by 1.7% to 8.9%.

- We expect the Bank of Botswana (BoB) to maintain interest rates at current levels in the medium term.

- We expect inflation to remain elevated and trend above the BoB’s objective range in the short term and fall within the range in Q2 2022 driven by base effects.

The FABI returned -2.1% for the quarter driven by Government bonds which declined by 2.5% owing to continued supply pressure. Corporate bonds on the other hand returned 1.2% for the quarter.

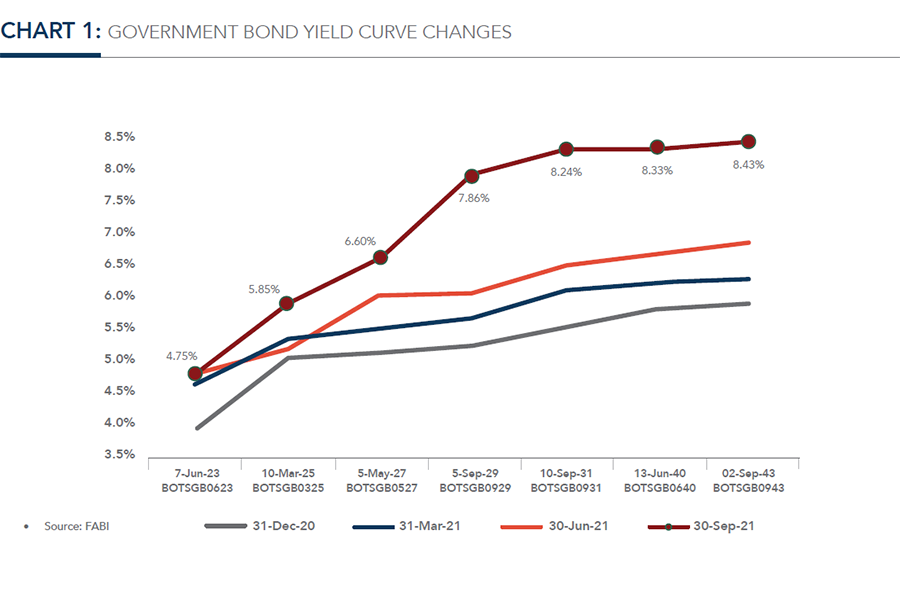

The pressure on Government bonds persists as yields continued to rise across the curve with the exception of BOTSGB0623 (2-Year bond) which experienced a 3bps drop in yield. The upward shift in the Government yield curve is expected to decelerate as yields on Government bonds have now become attractive to investors which limits further upside pressure on yields.

There were four Government bond auctions held during the quarter where P5.4bn of bonds and T-Bills were offered. There was strong demand with P8.1bn of bids received, however, in a similar manner to Q2 2021’s auctions, it was under allotted with an allotment ratio (allotment divided by securities on offer) of 68.3%.

The bulk of the allotment was at the short end of the curve where P2.9bn (79.6% of total allotment) of T-Bills were issued. On the long end of the curve, only one bond was not allotted i.e. the BOTSGB0623 (2-Year bond). The question still remains whether the Government can plug the funding gap caused by the continued under allocation of domestic issuances with external loans.

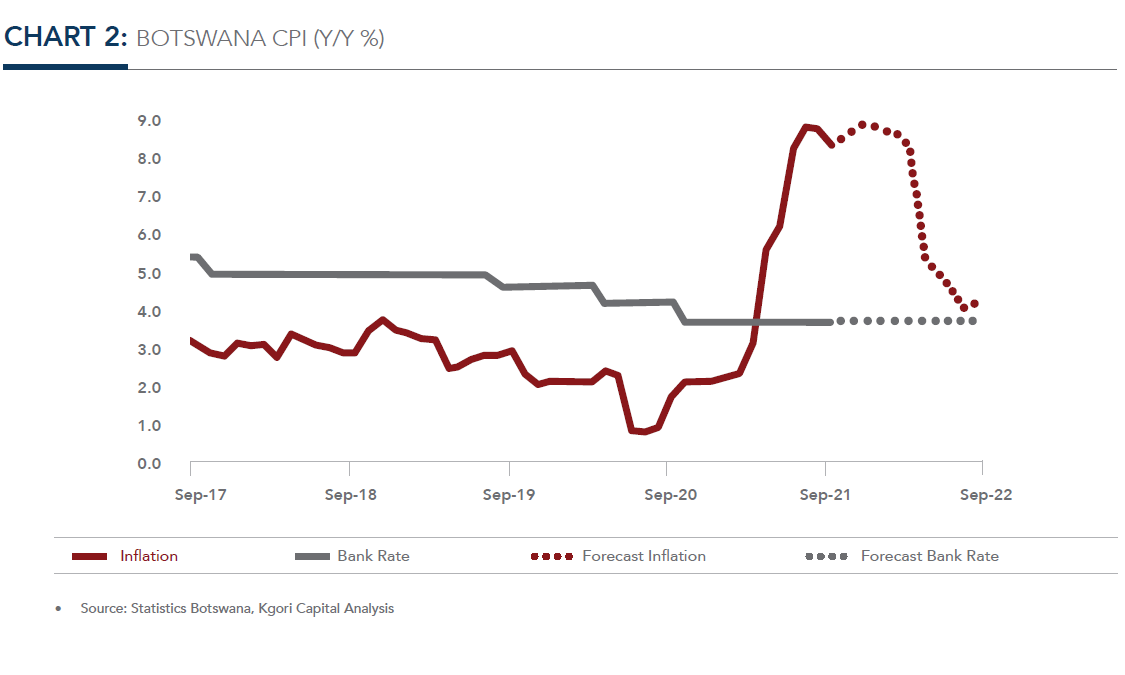

Inflation continued to trend above the Bank of Botswana’s (BoB) 3%-6% objective range with September 2021 inflation coming in at 8.4%, decelerating 0.4% from the 8.8% registered in August 2021. Transport inflation was the main driver for the decline in inflation, falling by 3.1% to 17.5% y/y in September.

The BoB Monetary Policy Committee (MPC) met once during the quarter on 19 August 2021. The MPC maintained the Bank Rate at 3.75% despite inflation continuing to trend above the upper bound of its objective range.

The MPC views the elevated inflation as transitory (due to factors such as increase in VAT, sugar tax, fuel levy and other administered prices) and hence maintained its accommodative position.

A trade surplus of P0.4bn was recorded for the month of July 2021. On a Last Twelve Months (LTM) basis, the trade deficit stood at P12.8bn in July 2021, a contraction of P12.7bn versus the P25.5bn LTM deficit recorded in December 2020. The main driver behind the improvement in the deficit was the normalisation in diamond trade which registered a surplus of P4.1bn in July 2021 and a much-improved LTM trade surplus of P36.7bn versus the P20.3bn recorded in December 2020. The economy continued to expand in Q2 2021, registering quarterly growth of 0.2% q/q on the back of the 5.0% q/q expansion in Q1 2021.

The continued relaxation of COVID-19 related restrictions during the quarter supported economic activity. The main contributor to growth came from the Mining sector which expanded 14.8% q/q. On an LTM basis the economy grew 4.9% y/y with growth recorded in most sectors with the exception of Agriculture (-3.2% y/y), Manufacturing (-1.8% y/y), and Accommodation (-19.2% y/y).

BoB released its August 2021 Monetary Policy Report, where it reiterated its accommodative stance to support economic growth as well as its expectation for inflation to remain above its objective range in the short term before reverting within the range in Q2 2022. However, short term inflation expectations, have been revised upwards due to higher commodity prices, improvement in domestic activity and higher inflation from trading partners.

The risks to inflation remain tilted to the upside but sluggish economic growth should keep inflation restrained in the medium term. July 2021 credit growth accelerated to 5.7% y/y from 5.3% y/y in June 2021. Household credit growth moderated by 0.3% to 9.3% y/y in July driven by “Other loans” which includes personal loans. Business credit increased by 1.7% to 2.9% in July supported by growth from Finance, Business Services and Manufacturing. S&P maintained Botswana’s “BBB+/A-2” long and short term foreign and local currency sovereign credit rating.

S&P however revised its outlook from negative to stable. The stable outlook is a reflection of S&P’s expectation that Botswana’s economic rebound, supported by a strong diamond sector recovery, will lead to material improvement of fiscal and external performance over the next 2 years.

Outlook

We have increased our 2021 GDP growth expectation by 1.7% to 8.9% following the rebasing of National Accounts to 2016 from 2006 previously. Due to the rebasing, Mining now accounts for 22% of the economy versus 10% previously. We expect a strong resurgence in Mining activity in 2021 as production was severely curtailed in 2020 due to lockdowns, travel restrictions and reduced demand.

INTEREST RATES

We expect the BoB to maintain interest rates at current levels in the medium term in order to support economic growth.

INFLATION

We expect inflation to rise in October 2021, due to upward pump price adjustments implemented on 8 October 2021, before continuing to decelerate on account of base effects. Inflation should fall within the BoB’s objective range in Q2 2022.