Market Insights – Botswana Equity

The DCI was down 0.8% for the quarter.

There is pressure on households from inflation,tightening monetary policy and a soft labour market.

Current economic headwinds have introduced a significant amount of forecast risk to our estimates.

Market Review

The DCI was down 0.8% and up 1.8% for the quarter on a price and total return basis, respectively.

The largest gainers for the quarter were Stanchart (23.6%), Letlole-La-Rona (LLR) (12.8%) and Botswana Telecommunications Limited (BTCL) (11.6%) on a total return basis. The largest losers were Choppies (-18.3%), Letshego (-9.1%) and Primetime (-5.0%).

Results releases were sparse this quarter. Cresta’s financial position showed improvement; the loss per share improved by 15.4% to -23.89t. An increase in revenue of 12.0% and a 16.0% decline in operating expenses drove performance. Though losses continued to erode group equity, operating cashflow is positive and sufficient cash buffers exist to fund operations for at least another year. Chobe full-year loss per share came in at -47.35t, a 37.5% improvement from the previous year which was attributable to increased occupancy rates from local travel. Advance booking receipts increased by 54.5%, showing stability in the group’s recovery.

New African Properties (NAP) interim earnings per linked unit (EPLU) increased by 8.8% on the back of rental revenue growth and declines in impairments. The Group purchased three properties during the period, funded from internal cash reserves. Primetime interim EPLU came in at 16.51t; over seven times higher than the previous comparable period due to positive exchange differences. Rental revenue also grew as discounts given to tenants to weather the COVID storm continue to fall away. Turnstar full year EPLU was up 28.6% to 18t as operating profits increased 15.1% and previous year impairments did not reoccur.

Seedco full year EPS was 1.8t, 36.8% lower than the previous year as late rains lead to lower volumes and the product mix tilting in favour of lower margin seeds. BTCL full year

EPS came in 2.1% higher than the previous period at 13.41t on the back of cost savings and reduced impairments.

On the corporate actions front, LLR completed negotiations to acquire up to 50% of a special purpose vehicle that owns 100% shareholding in a company that in turn owns industrial property in Nairobi, Kenya. The total consideration is estimated to be USD 14.8mn, paid in 2 tranches to Grit Services Limited, a subsidiary of Grit Real Estate Investment Group (Grit). Given that Grit is a 30% shareholder in LLR, an Extraordinary General Meeting (EGM) seeking shareholder approval for the transaction will be convened.

Cresta did not renew the lease on the Zambia property and signed a lease agreement with Debswana Pension Fund to develop a new 50-room boutique hotel in Jwaneng.

MARKET OUTLOOK

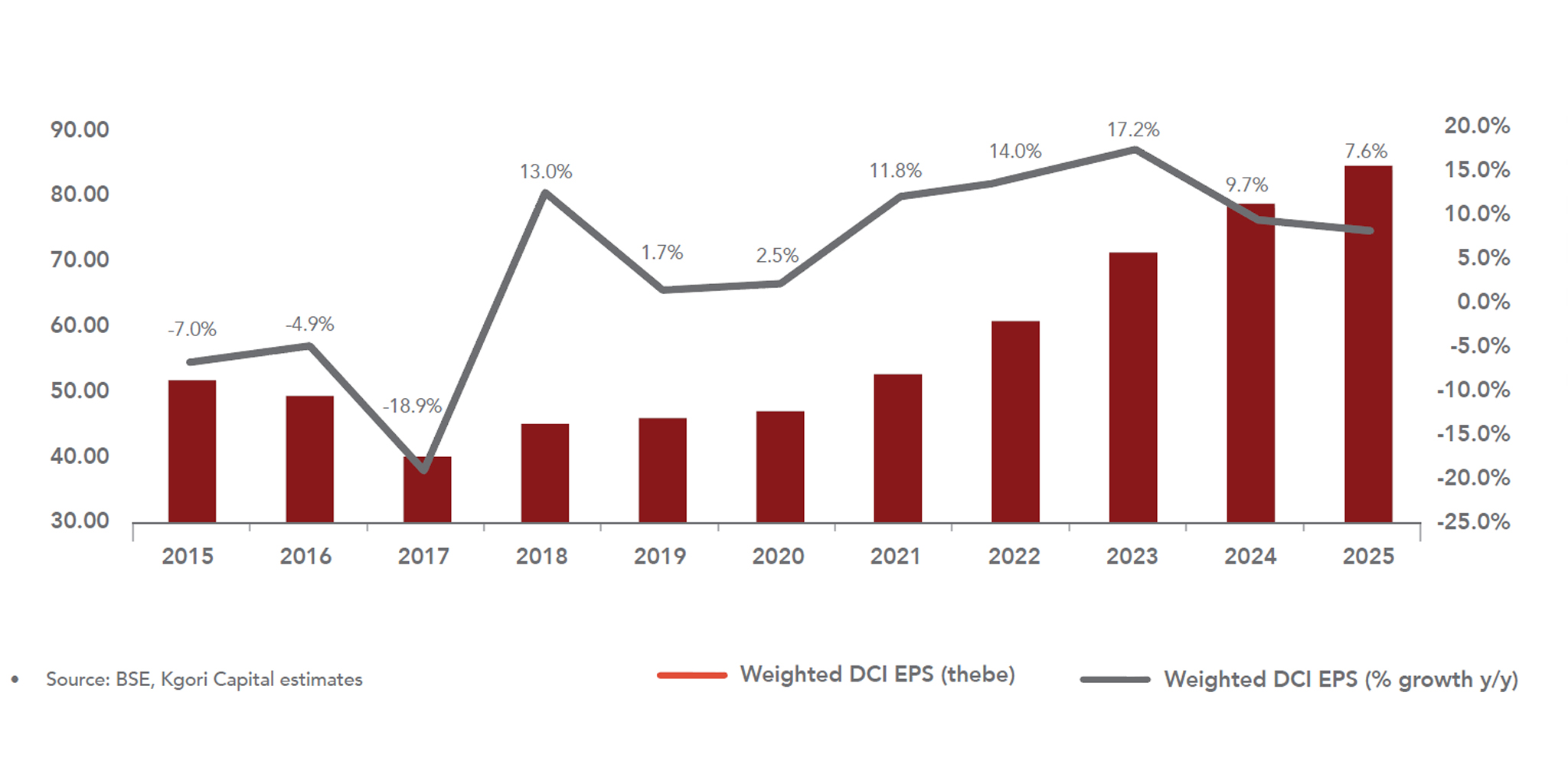

Earnings expectations have trended upwards but current economic headwinds have introduced a significant amount of forecast risk to our estimates.

CHART

BOTSWANA EQUITIES: EARNINGS PER SHARE (MARKET CAP WEIGHTED)

Inflation remains a key variable both internationally and locally.

The sustained demand for rough diamonds has presented an opportunity for fiscal buffer rebuild and a sustained positive mining GDP growth beyond the initial COVID recovery upswing.

This should be positive for fiscal spend going forward. Additionally, the rise in interest rates is positive for overall banking sector profitability. That said, persisting tight market liquidity will drive cost of funding higher and dampen margin expansion. We are also keeping a keen eye on impairment levels due to pressure on households from inflation, tightening monetary policy and a soft labour market.

Property sector earnings growth continues to perform to expectation as rental discounts and impairments fall away and the sector returns to normalised rental levels. Pressure on businesses is expected to anchor escalations below average inflation.

The hospitality sector continues to operate below break-even levels, but the recovery is starting to come through. Losses are reducing, advance bookings continue to tick up and both players are expanding operations.

Download PDF (LE commentary Q2 2022)