Market Insights: Botswana Equity

- The DCI was up 11.1% for 2021 on a total return basis.

- Core inflation continues to trend above headline inflation objective range, driven largely by imported inflation.

- The road to recovery remains uneven and forecast risk high.

The DCI was up 4.4% and 11.1% for the year on a price and total return basis, respectively.

The largest gainers for the year were Letshego (128.0%), SeedCo (51.8%) and Stan chart (49.0%) on a total return basis. The largest losers were Minergy (-37.5%), Chobe (-22.6%) and Primetime (-19.1%).

NAP full year operating earnings registered inflationary growth of 4.2% while Earnings per linked unit (EPLU) increased 8.1% due to positive tax effects. Primetime full year operating earnings were flat year-on-year, while lower revaluation losses led to positive EPLU of 8.86t from a loss the previous year. Turnstar interim operating profit was up 17.3% on the back of higher revenue and lower operating expenses; EPLU increased 40.5%.

Chobe interim loss per share reduced 36% to 25.04t from 39.38t as occupancies improved to 17% from 8% in the previous comparable period. The industry remained under pressure, but the Group’s advance travel receipts increased by 51.0%, a positive indicator for forward bookings.

BTCL interim earnings per share came in at 8.16t, 30.1% above the previous year as margin expansion on the back of cost declines made up for a decline in revenues.

On the corporate actions front, Access Bank Plc completed its acquisition of 78.15% of BancABC Botswana share capital; the Bank subsequently rebranded to Access Bank Botswana Limited. Additionally, Tlou Energy signed a Power Purchase Agreement with Botswana Power Corporation (BPC) under which agreement BPC will purchase up to 10MW of electricity from Tlou’s Lesedi power project.

Our sentiments have not changed from last quarter as the overarching theme still holds true within the constantly evolving landscape.

The main conversation being what the optimal exposure to local equities is as earnings expectations trend upwards in a market that is cheap relative to historic levels. The dispersion in individual company performance remains high, with few counters driving much of the index performance in the last year.

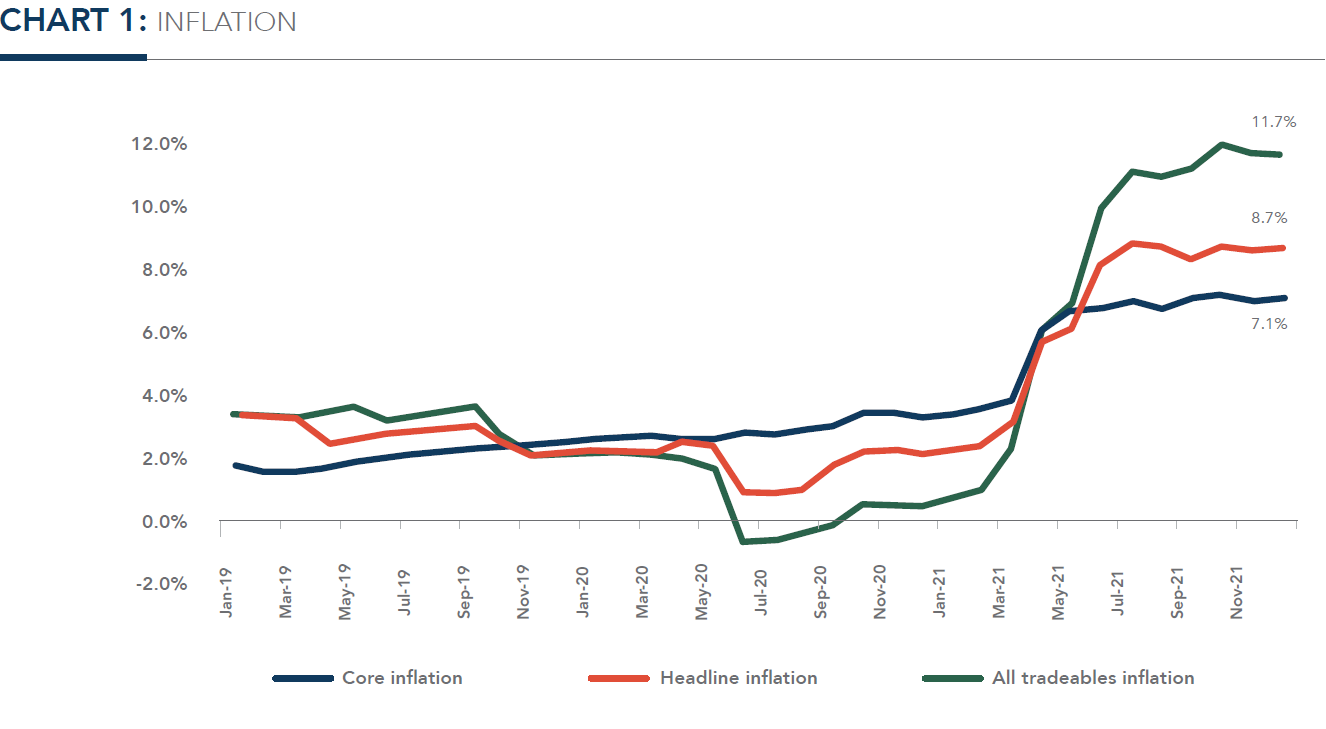

Inflation remains a key variable both internationally and locally. Core inflation, a gauge of underlying long-term inflation, continues to trend above the headline inflation objective range of between 3.0% to 6.0%.

The primary driver for this is an elevated All Tradables inflation, which is fuelled by double digit imported inflation.

The uptick in inflation, though negative for low-income households, is positive for the Property and Consumer Staples sectors. We expect the Consumer Staples margin expansion to continue, and inflation linked property rental escalations to be positive for the property sector.

The hospitality sector remains in the doldrums. We have noted the uptick in advance bookings post the lifting of the State of Public Emergency (SoPE) and roll-out of the vaccination programme – a positive indicator that the reopening of the sector is gaining traction, albeit from a very low base. Despite the green-shoots, the uncertainties facing the industry remain.

Labour statistics have not been published for the year 2021 so we are unable to glean any employment and wage growth trends yet; it will be interesting to see how the recovery in GDP we have seen in the last three quarters has translated to Households. In the meantime, the return of mining activity and operating consistency in most sectors will be positive for the fiscus.

The road to economic recovery remains uneven and forecast risk high. The uneven nature of the recovery and the uncertainty around the timing of fiscal support flow keep balance sheet strength, market positioning and dividend flows in centre stage.