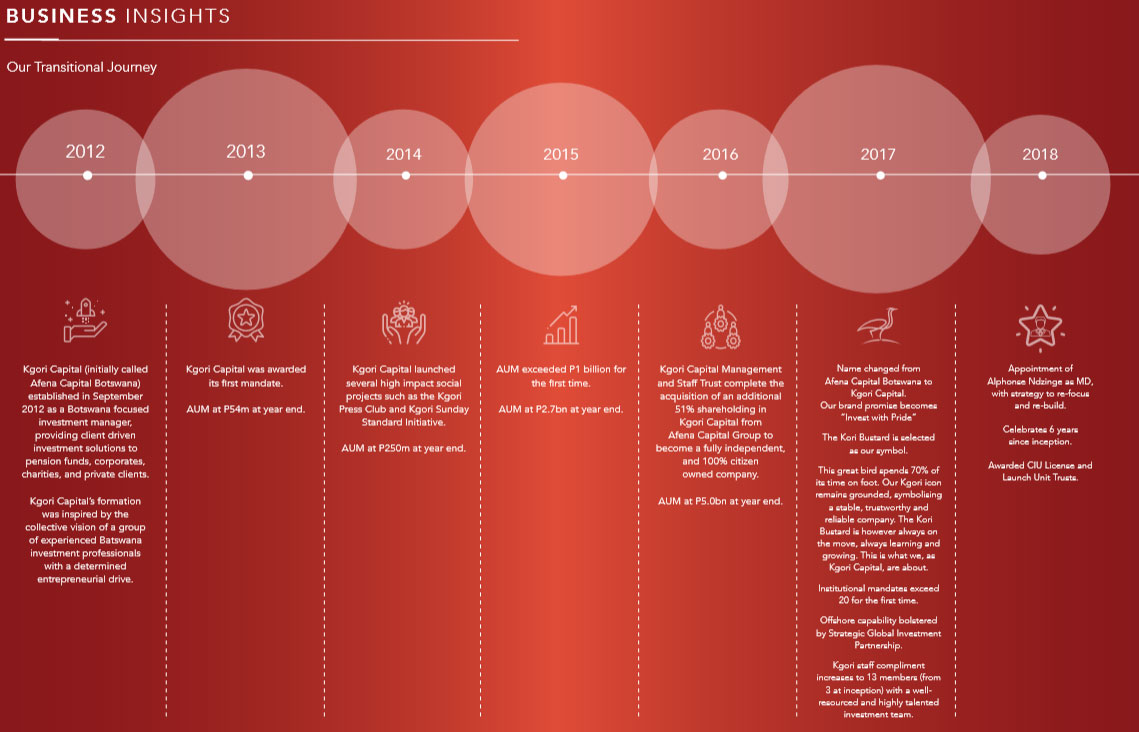

Kgori Insights – Quarter ended September 2018

Business Insights – Investing Environment

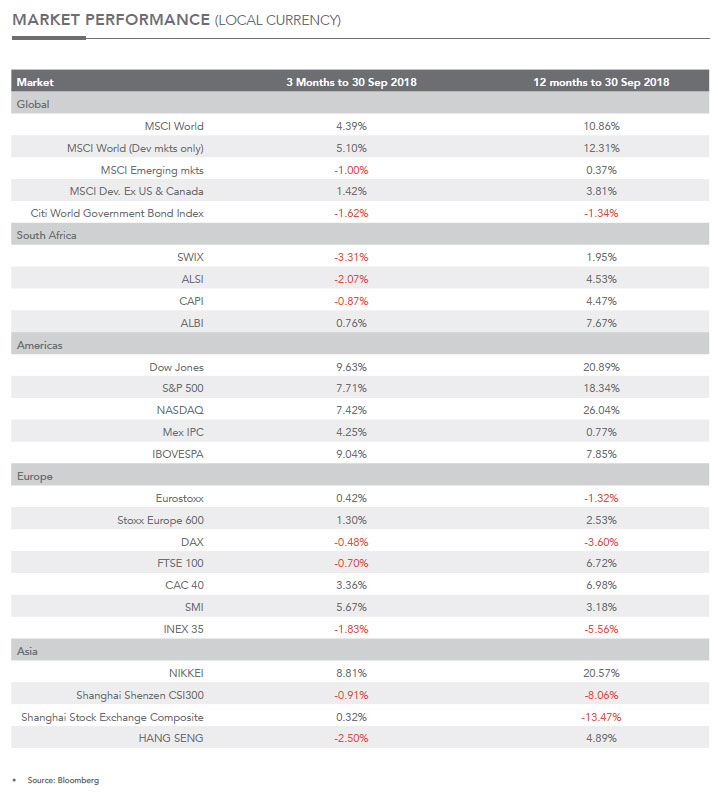

Local equities had another difficult quarter, declining 6.8%. The main detractor was Choppies, declining 84% as the delay in publishing results and a negative profit warning spooked investors. Local bonds returned an acceptable 1.2% as yields were relatively flat.

Global Equities (MSCI World Index) continued to rally, rising 6.3% in the third quarter, which translates to year-to-date gains of 12.3% in BWP terms. Health care, information technology, and industrials were the best absolute performing sectors within the Index. Conversely, real estate, materials, and utilities were the main sector laggards.

Geographically, the US equity market (S&P 500 Index up 9.6%) was the standout performer underpinned by robust earnings and a positive macroeconomic backdrop. Japan also had a strong quarter, returning 8.1%, boosted by Prime Minister Abe’s intraparty re-election. In contrast, emerging market equities (MSCI Emerging Markets Local Index) returned 0.8% in Pula terms, translating to year-to-date losses of -0.4%.

10-year US Treasury yields ended the third quarter above 3.0%, their highest levels since May 2018 and 2-year US Treasury yields ended at the 2.8% level by the end of the third quarter. Yields on 10-year German bunds increased almost 17 basis points (bps) during the third quarter. 10-year Japanese Government bond yields rose nearly 10bps in the third quarter, their largest increase in almost two years. The Pula depreciated 1.9% against the US Dollar and strengthened 1.1% versus the Rand. The US Dollar (DXY currency index) trended close to the 95 level for most of the quarter, rising just 0.7%. The Euro also stayed close to the 1.16 level for most of the quarter.

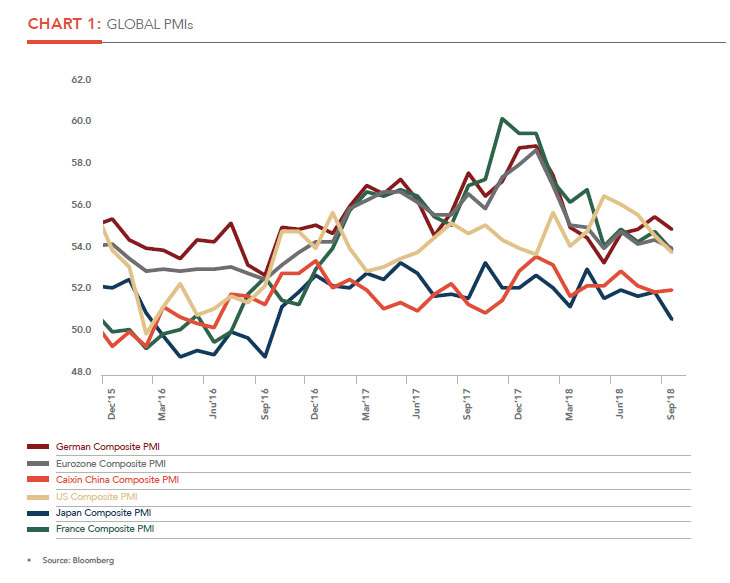

Global growth is expected to remain firm in 2019, though at a slower pace. World growth is expected to stay strong next year (3.6% y/y after 3.7% in 2018), but the economic cycle looks less synchronised across the main regions. Trade issues and domestic political risks reduce visibility on the global outlook and fuel downside risks to growth. Central banks in developed countries should continue to normalise their policy, while financial conditions have significantly tightened in emerging countries. Trade issues are weighing on emerging economies, while the policy mix in the US continues to fuel above potential growth. There are, as always, several risks to our outlook. Political risks top the list, such as the escalation and broadening of US-China tensions, or an intense confrontation between the European Union and Italy’s government. While relative value has shifted, risk has also been on the rise as a consequence of higher rates, higher oil prices, and the evolving US-China situation. Most analysts do not expect a recession before 2020. This does not automatically imply that riskier asset prices will rise in the next few months and will continue to rally next year. By and large, we expect (more) downward pressure on asset prices in the short-to medium term.

We believe the major economies are running at (or fairly close to) full capacity utilization, we face the end of an era of economic growth, increasing profits, low inflation, and loose(r) Central Bank policy… all at the same time. In other words, the very favourable backdrop for asset prices is disappearing. Furthermore, the transition from extraordinary policy stimulus to less loose monetary policy has already hit some asset classes hard, including industrial metals, EM asset prices and currencies, European equities, and corporate bonds.

US asset prices have done relatively well but this is largely due to very high stock buybacks by US businesses and the fact that many investors have sought a safe haven in the US as unrest gripped the Emerging Markets recently. Finally, our expectation is that there will be downward pressure on growth next year due to a declining fiscal impulse in the US, the delayed impact of Fed tightening, the negative impact of the trade war between the US and China, and on the back of restiveness and monetary tightening in the Emerging Markets.

BUSINESS OVERVIEW AND STRATEGY

Our long-term investment performance track record remains excellent. This is due to a tried and tested investment philosophy, which is based on identifying investments that are trading at material discounts to their underlying long-term value. When constructing portfolios, we carefully consider appropriate position sizes and asset allocation weightings to create robust portfolios that have the ability to meet investors’ long-term objectives on the most optimal risk adjusted return basis.

Our entire range of client portfolios continues to yield strong returns, supporting our track record of producing significant market-beating returns over all meaningful time periods. Since inception, 100% of Kgori Capital’s institutional and retail clients have outperformed their respective benchmarks. This is a remarkable achievement in the industry. Our proudly Botswana business continues to focus on building a world-class investment management firm. The long-term sustainability of the business rests in our continuing ability to add value to all our clients. We continue to invest in our solution offerings, ensuring that they remain competitive and relevant to the changing needs of investors, and are available at their chosen point of access.

Critical to our success is our ability to attract, retain and motivate talented individuals in every area of our business. Innovation and awareness are at the core of the Kgori Capital culture. As an investment manager, our people are our only true asset. We encourage and expect our people to question the way things are, search for ways to do things better and be open to a diversity of information and opinion. Over the past few years we have also been planning some significant changes to the business and this year saw the implementation of some of these initiatives. We are excited about the benefits that these will bring to our business.

For instance, the past quarter heralded a new chapter in Kgori Capital’s history with the launch of our unit trust (pooled offerings) business. This followed approval of our Collective Investment Undertaking (CIU) License by NBFIRA. The first of our unit trust solutions is the Kgori Capital Enhanced Cash Fund, launched in August 2018. We will continue to make investments in our business, specifically in the technology to enhance our clients’ service experience and to achieve greater operational efficiencies. We also remain extremely vigilant of all technology-related risks.

GOVERNANCE

The global trend towards more intrusive and intensive regulation of the financial services industry continues. For the foreseeable future, the agenda looks set to remain demanding and is likely to have far-reaching implications.

As a participant in the financial services industry, we fully support the adoption of appropriate regulations that will improve industry wide governance and hopefully lead to an increase in household savings and real growth in the economy. In our view, to encourage broader participation in the financial sector, it is critical that the needs of the investor be safeguarded. We continue to monitor developments to assess their impact on our business.

As an active participant in the financial services industry, we also engage with policymakers and regulators through our industry associations. As a leader in the Botswana investment management industry, we embrace good corporate citizenship and the importance of robust governance. We are grounded by strict Values and Principles, and guided at all times by absolute transparency, best practice, and sound corporate governance befitting the trust our clients and stakeholders place in us.2018 has proved a defining year for Kgori Capital and we made large investments inthe business to ensure the best outcomes for all of our stakeholders.

Over the past year, the Board and Executive Management spent much time engaging with stakeholders to get their views on our business. We have been encouraged by their support and considered insights, as well as the clear understanding that Kgori Capital is aligned with their interests. We have been aligning the business to global best practice governance principles. In August 2018, the Board of Directors and Management opened our books and our business for an independent voluntary audit conducted by Deloitte. This comprehensive Internal Controls Review and Gap Analysis tested our business practices, compliance, risk management and operational structures against stringent benchmarks has confirmed that Kgori Capital is managed to a high, world class standard. The Kgori Capital Board of Directors was bolstered through the appointment of a new Chairperson and an independent Non Executive Director.

Our new appointments bring in a wealth of international experience, expertise, and the kind of credibility necessary to complement and enhance our services to Botswana and strengthen independence on the governing body.Mr. Kennedy Itumeleng Melamu, an independent Non-Executive Director, was appointed as the Chairperson of the Board in May 2018. He is a qualified attorney and a Motswana with over 25 years’ corporate experience. He is currently Chief Executive Officer of MTN Sudan. Mr. Motsile Stephen Sibanda was appointed as an independent Non-Executive Director in July 2018. He is a Motswana with over 24 years’ experience and sector insight. As a seasoned human resource practitioner, he has served in senior management roles at Stanbic Bank Botswana, Standard Bank Group, and BCL Limited.

CONCLUSION

We continue to invest in the sustainability of our business, including our operational capabilities, business support functions and client service infrastructure. In addition, we pride ourselves on attracting and retaining the best talent across all areas of the company. Throughout, we remain committed to our proven long-term investment philosophy and our robust investment process. We believe that this will continue to generate long-term value for all stakeholders through the cycle.

I wish to thank all of our staff for living our investment-focused and client-centric culture over the past six years. It is a privilege to be associated with such a highly motivated and talented team of individuals, each with their own set of skills, diverse background and work experience that combine to make Kgori Capital a success. I also thank my fellow Board Members for their considered counsel, and to our clients, intermediaries and stakeholders, we thank you for your continued trust in our ability to create long-term value.

Market Insights: Offshore Commentary

Over the third quarter, the significant performance gap between stock markets around the world stretched even wider, as emerging markets suffered a rising US Dollar; a series of political and economic crises with pronounced sell-offs in Turkey and Argentina; and fresh export tariffs.

The MSCI Emerging Markets Local Index declined 1.0% in the third quarter, adding to its year-to-date losses of 7.5%. On the other hand, developed market equities (MSCI World Local Index) gained 4.8% in the third quarter. Stocks in the US, however, grew at an exceptional rate with robust earnings and a strong macroeconomic backdrop. The S&P 500 rose 7.2% over the quarter, sustaining its upward trajectory since mid-March despite increasing trade tensions. More significantly, as the ten-year anniversary of Lehman’s collapse came and went, the S&P clocked what was – by some definitions – the longest Bull Run in its history. The US technology sector outperformed even this broader benchmark, as profits continued to escalate. In Japan, Prime Minister Abe’s intraparty reelection helped drive equity markets (Nikkei 225 Index), which gained 8.1% in the third quarter. In contrast, European equities (Euro Stoxx 50 Index) lagged its major developed market peers with a 0.1% increase in the third quarter.

Ten-year US Treasury yields ended the third quarter above 3.0%, its highest levels since May. Another interest rate hike in September by the Federal Reserve drove two-year US treasury yields to the 2.8% level by the end of the third quarter. In Europe, yields on ten-year Italian government bonds ended the quarter up nearly 47 basis points based on rising concerns around the expansionary budget proposal delivered by the new Italian government. Yields on ten-year German bunds also increased almost 17 basis points during the third quarter. Ten-year Japanese Government bond yields rose nearly 10 basis points in the third quarter – the largest increase in almost two years – after the Bank of Japan announced a more flexible target

range for its yield-curve control programme (YCC) in July’s monetary policy meeting.

The US Dollar (DXY currency index) trended close to the 95 level for most of the third quarter rising just 0.7%. The Euro also stayed close to the 1.16 level for most of the quarter, while the Japanese Yen depreciated 2.5% to 113.7 this quarter. Emerging market currencies (MSCI Emerging Market Currency Index) fell 1.6% in the third quarter driven by steep sell-offs in the Brazilian Real, Chinese Yuan and Indian Rupiah, the latter of which traded near the weakest recorded levels against the US Dollar. The Mexican Peso, on the other hand, bolstered by a signed dealin-principle with the US regarding its trade relationship, rose 6.4% in the third quarter–a standout relative to its emerging market peers.

Our view on the Global Economy was left unchanged, still consistent with expectations for strong global growth conditions for the next 6-12 months. Market sentiment has turned more bearish, but the broader global growth fundamentals didn’t change significantly since last quarter. US growth continues to hold near the 3% trend from the first half. Global PMIs have deteriorated a bit further, but are not close to contractionary territory. Meanwhile, labour markets continue to tighten in nearly all developed world economies, highlighting the robust consumption backdrop.

Thus far, 2018 has been characterised by a remarkable divergence in the trajectories of US assets and non-US assets. US equities remain the only equity market with positive performance, while EM assets and currencies have been severely punished. The question now is what lies ahead: convergence or continuation of the current pattern? We see 2019 as a year of resolution.

High Calibre Team of Investment Analysts

The issue at the top of our team’s minds is the potential for trade tensions to escalate into a full-blown trade war. Prior to recent trade-related shots between the US and China, China’s economy had been slowing as a result of its earlier deleveraging campaign. Yet Chinese policymakers have begun to re-stimulate. Whether these quick reversals in direction become meaningful in amplitude will be important to the fundamentals of EM markets, commodities, and European exports. So too will the extent to which the US continues to escalate its trade battles with China. The escalating trade war with the US is beginning to have significant effects, as Chinese firms postpone capital investments to improve productivity or expand capacity in the face of uncertainty. As of now, our analysis suggests that Chinese policymakers have the willingness and ability to put a floor on economic growth primarily through infrastructure investment, which will be potentially supportive of certain EM.

In Europe, political uncertainty in the form of the Brexit negotiations, as well as Italy’s budget negotiations, remains elevated but should reach resolution in the next few months. For Brexit, concerns linger about the deal passing through UK Parliament and the likely political upheaval. Italy and the European Commission look to be on a collision course. The Italian budget plan includes substantial deficit spending, of around 2.4% of GDP for 2019 and the targets in 2020 and 2021 look unrealistic from a growth perspective, even after adjusting for a fiscal boost. The EU Commission is unlikely to approve this plan. That said, the somewhat puzzling weakness in European growth this year has finally stabilized; its direction will also become clear in 2019.

For now, our sense is that the net result of all these cross-currents will be a convergence toward stronger non-US fundamentals.

Market Insights: Local Commentary – Equity

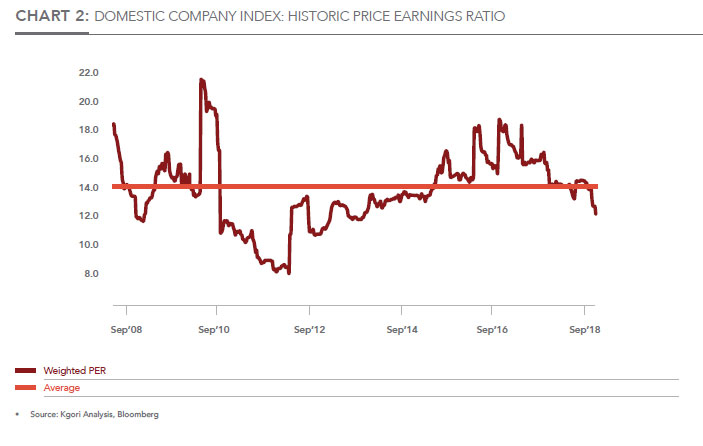

The Domestic equity market had a rough quarter, declining 6.8% and 5.1% on a price and total return basis respectively. The biggest loser for the quarter was Choppies; losing 84% of its value to trade at an all-time low of 40t.

Earnings season kicked off with the consumer retailing stocks releasing their results. For their year-end performance, Sefalana achieved a 12.0% increase in revenue and a 38.5% increase in profit before tax (PBT). Though overall performance was positive, the results showed a contraction in the gross margins of just under 100 basis points (bps) of the Botswana Trading Consumer Goods segment. Sechaba’s performance remained subdued, reporting a 15.6% decline in profit after tax (PAT) for the interim period. Volumes continued to decline and the excise duty charged on production ate into margins. CA Sales results painted a better picture as the entity recorded a 28.0% growth in revenues and a 27.0% rise in profitability driven by organic growth as well as acquisitions. The release of Choppies year end results was delayed.

This is the second consecutive time results have been delayed and market sentiment soured as a result of the uncertainty. Stanchart released HY18 results showing a profit of P22.7mn for the period, compared to a loss of P57.4mn the previous comparable period. Despite this improvement, profit before impairment losses was down 70.6% as cost growth continues to outpace revenue growth. Barclays recorded a 4.8% rise in PAT driven by a rise in Fee and Commission income, as well as a decline in the impairment charge. FNB results surprised on the upside, showing a 29.5% increase in profits. This was driven by a 24.1% decline in impairments and a 9.4% increase in Fee and Commission income.

For the non-banking financial sector, the BIHL Group interim results showed a 6.9% increase in profitability as growth was registered in both single and recurring premium income lines. Letshego’s PAT increased by 10.6% driven by a 10.0% increase in advances. A reduction in impairments was also positive for performance. The company appointed Smit Crouse as Group Managing Director; he has extensive experience in advisory within the banking and corporate finance space.

Despite revenue growth of 8.6%, Cresta registered a 53.7% drop in profitability. The recently opened Maun hotel is loss-making; a major cholera outbreak in Lusaka lead to a five month ban of large gatherings; and annual rental escalations above inflation have all put pressure on the company’s profitability. Letlole la Rona (LLR) profit for the year rose 6.4% on the back of above inflation growth in rental income. The acquisition of Watershed Mall happened towards the end of the year, for that reason the full impact is expected in the coming financial year. FAR property results showed a decline in profit for the year by 39.9%. Engen registered profit growth of 32.9% on the back of increases in the value of fuel inventories. That said, performance excluding inventory profits showed that profit was down 36.2%. Furthermore, volumes sold were lower for the period and ballooning slate under-recoveries are putting pressure on the company’s cash flow.

On the corporate actions front, Stanchart raised Tier I capital through the issuance of P400mn Undated Unsecured NonCumulative Subordinated Capital Securities to Standard Chartered Bank PLC. This was necessitated by the reduction in retained earnings as the company wrote off loans in three consecutive financial years and the implementation of IFRS 9.

Seedco listed on the BSEL domestic main board, while Botswana Building Society (BBS) listed on the Serala Board; the Over-theCounter board of the BSEL. BBS is awaiting a response to their application for a banking license which will allow them to convert from a Savings and Loans institution into a fully-fledged Commercial Bank. Beyond this, very little has been communicated by the company in terms of strategy going forward and their plans. Sechaba held an EGM where shareholders approved the separation of the beer and cold-drinks business into two separate entities. Sechaba now holds a 49.9% stake in KBL and a 49.9% stake in Soft Co. which will be run by Coca Cola Bottling Africa.

During the quarter we saw a change in the major shareholders of Wilderness; the shares being acquired by The Rise Fund (34%) and African Wildlife Holdings (24%). In addition to this, the company disposed of one of its assets to a former shareholder, Wine Investments. Minergy was awarded a mining license and has begun work on the mine and wash plant. The company expects to commence production in January 2019. Looking to the banking sector, the upgrade in the Government payment system, as well as the movement in some pension fund cash into the offshore market, negatively impacted market liquidity and led to increases in cost of funding for the sector. This tightness is expected to continue as government special funds are moved to the Central Bank. Going into the election year, the market had anticipated a ramp up in government spending on projects; as at quarter-end, projects hadn’t started to come through. IFRS 9 had a smaller impact than anticipated on the commercial banks, expected credit losses on the old loan book were provided for on the balance sheet. We are therefore seeing a reduction in the impairment charge on the income statement and lower net advances on the balance sheet. Banks are still chasing yield therefore Retail advances are expected to anchor growth going forward; with an emphasis on fee and commission income.

Internationally informed. Locally invested.

Imported food disinflation continues as the Pula benefited relative to the Rand, from Dollar strength; this is positive for consumption but not beneficial for retailers. There is increasing price competition amongst retailers which is negatively impacting margins and profitability. The downward revision in the alcohol levy should boost volume sales for Sechaba and have a positive impact on its performance going forward.

Grounded, trustworthy.

We are anticipating growth within the mining sector as Minergy commences construction of the mine and wash plant; Shumba is also in the process of procuring a wash plant, and Tlou Energy has submitted their response to an RFP issued by Government for coal-bed methane power production. Activity within the non-diamond mining sector is ramping up as regional and international prices remain favourable.

Overall domestic equity market sentiment remains weak, with retail investor liquidations continuing. That said; valuations on a number of counters have become compelling. We are seeing a steady increase in companies looking to list on the BSE and see this as positive for the development of the local market. With strong selling pressure and muted demand on certain counters, this remains a buyers’ market.

Market Insights: Local Commentary – Fixed Income and Macroeconomics

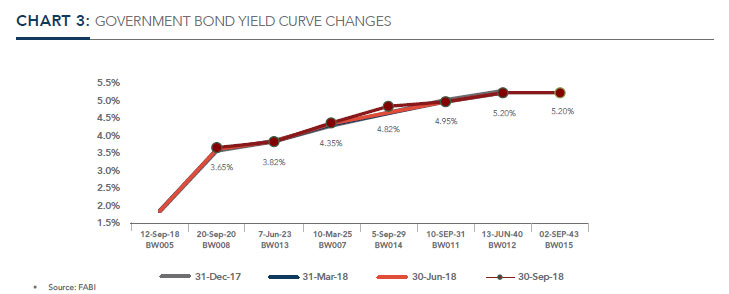

The FABI return of 1.2% for the quarter was exactly in line with the previous quarter. The government bond yield curve remained largely unchanged. The BW008 maturing in 2020 and the BW007 maturing in 2025 rose 5bps and 2bps respectively. The BW013 maturing in 2023 fell by 1bps.

The August Government Bond and Treasury Bill Auction saw bids of P1 976mn, higher than the P1 736mn of bids received in the June auction. The issuance was oversubscribed by P476mn. The most demanded instrument was the BW013 bond maturing in 2023; oversubscribed by P245mn. There was a new issuance; the BW015 maturing in 2043. The bond was oversubscribed by P111mn as investors welcomed the introduction of another long-dated bond.

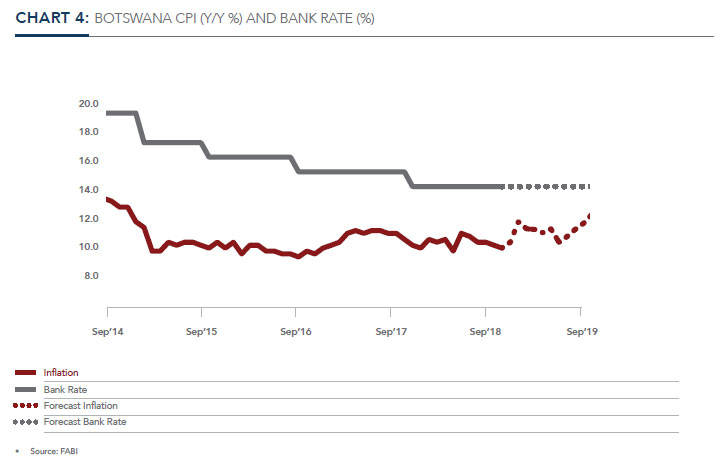

Inflation remains stuck at the bottom end of the Bank of Botswana’s 3%-6% objective range, September inflation was 2.9% y/y. Inflation remains tepid due to low food inflation driven by plummeting Bread & Cereals inflation. The main driver of inflation has been increases in administered prices. Excluding administered prices core inflation was at 1.6% in September.

We expect 2018 to be another year of stable growth, we forecast growth of ~4.0%. This is below the Ministry of Finance and Economic Development’s forecast of 4.6%. The lower growth expectation is on account of more moderate expectations of Trade, Hotels & Restaurants. Mining is expected to continue its recovery due to resurgence in diamond activity. Diamond demand is largely driven by retail diamond sales in developed markets.

Developed market consumers are growing in confidence due to a continued rise in global equity markets, loose monetary policy and US tax reforms. We have seen signs of this playing out; with Q2 2018 Mining Production Index growing by 6.5% y/y. Diamond production contributed 5.4 percentage points of the growth.

We do not expect the Bank of Botswana to reduce rates further unless inflation continues to trend below its objective range. We do not expect this to be the case on account of increases in administered prices. We maintain our 2018 year end inflation expectation of 3.7%. Inflation will remain in the lower half of the Bank of Botswana’s objective range due to lower than expected rises in administered prices such as water and fuel, subdued domestic demand and low food inflation.

Unit Trusts: What you need to know and how to invest wisely

What are savings? To answer this in a very simplistic manner, this is the amount of money that you have left after all your expenses have been paid for. Big or small, any amount of savings over the long-term adds to your financial wellbeing and stability, as well as ultimately feeding into overall economic sustainability.

Saving money does not have to be a difficult task; it just requires practice. Once you get into the habit of consistently putting money away, it is possible to save enough for

emergencies, retirement, or any other goals you were hoping to achieve. Here are some ideas to boost your savings and transform your financial life through investment.

Remember, savings are not the same as investments, but smartly working the two of these in parallel can see great impact.

Lessons from someone wise:

- Work with a budget;

- Beware of debt;

- Maintain a clean bank account;

- Belong to a medical aid scheme;

- Have a will and life cover for debt; and 6. Save today to spend tomorrow.

You work hard and expect your money to work even harder. The important question to then ask is, “How do you want it to work for you?” There are tools that are available to help you achieve this, being Collective Investment Undertakings (CIUs) or also known as Unit Trusts.

Ethical values of responsibility, accountability and transparency.

What are CIUs?

- CIUs are an investment pool for many investors which allows them to pool their money to purchase various assets such as equities, bonds, listed property and cash

- Assets are held in trust by a corporate trust

- The funds are open-ended i.e. investment fund that continuously offers its securities to investors and stands ready to redeem its securities at all times

- Funds are managed by a licensed Investment Manager (such as Kgori Capital)

- Unitised pricing allows for daily valuation

- There are daily investments and withdrawals

- Easy access for all investors, large or small

Why invest in CIUs?

- They are easy and accessible, and you can invest in a Unit Trust for as little as P200 a month (monthly debit order) or a P10,000 lump sum. You have access to your funds in about 48 hours.

- You always know how much you own, they are in units, you know how many you have and you can check their value as the price is published.

- Good value. The annual management fees are competitive and are very transparent.

- Your money is safe as it is held in a trust account – and not by the investment company.

There are a number of ways a Unit Trust can help you increase the value of your money. It can give you income or capital growth, or

both. The decisions you take will depend on your specific circumstances, the stage of your life you are in, how much risk you are willing to take on, and so on.

How do CIUs give you growth?

- We have all heard of the saying, “do not keep all your eggs in one basket.” Unit Trusts spread your risk so the bad performing bumps along the road are ironed out by the better performing assets. This is also known as ‘diversification of investments.’

- Gains and losses are called investment returns and are made up of asset price increases, dividends paid by companies to shareholders and interest earned from bonds or cash.

- Unit Trusts are managed by the best of the best: highly qualified, skilled and experienced investment managers, with the time it takes to make the best decisions for the investors.

- History has also shown that the longer you leave your money in most Unit Trusts, the greater the opportunity for growth.

Unit Trusts are one of the most affordable and simple ways to invest, especially if you do not have the time, interest or knowledge to invest your money on your own. CIUs are highly regulated and have a trustee who is independent to the investment manager. #

This is key as the trustee acts like the fund’s custodian and ensures that the Unit Trust is managed according to the guidelines laid out in the trust deed.

How to invest

- Request a copy of the prospectus of the fund, minimum disclosure document or fact sheet and an application form

- Complete application form with relevant Know Your Client (KYC) information, and submit to the investment manager

- Make a payment in to the fund inflow account

- Receive welcome letter from the fund manager with account details for future additional investments

- The fund manager will continuously provide valuation and transaction statements, minimum disclosure documents or fact sheet on the fund, as well as income distribution statements. Online access to view fund details would also be available.

So what are you waiting for? CIUs are a great investment platform for the beginner or the savvy investor and provide a sound means through which to invest your money, and invest in your future. The features and benefits are well-suited to those looking for low-risk investments, as well as a flexible investment vehicle. As Warren Buffet said, “The greatest investment you can make is an investment in yourself……The more you learn, the more you’ll earn.” This means it is paramount that you invest time in learning about this investment opportunity, ensuring your own due diligence, and asking all the questions you need to in order to make an informed decision.

With the recent introduction of Unit Trusts by Kgori Capital, we ensure you have even greater opportunity for a diverse investment portfolio, and are taken care of by a true

Botswana business with your interests at heart. This is because Kgori Capital is proudly a home-grown, Botswana-focused investment manager, passionate about Botswana’s growth, and the development of her economy and her people. Simply put, we invest with pride for Batswana, with Batswana, and our Unit Trust option is yet another example of this.

Get to know our team: Meet Kirsten Cutten

“The Kgori Capital team is driven by a passion for Botswana and for excellence. Having been there the longest, I sometimes marvel at how the team came together in a way that is seamless like a neatly woven basket”.

Full Name: Kirsten Cutten

Role: Team Assistant

Number of Years with Kgori Capital: 6 Years

What is the biggest growth moment you have achieved during your time with the team? Your biggest milestone?

In 2013, Sharifa, COO said, “Kirsten, a client is coming to our office this afternoon, can you take her through the monthly report?” My heart almost stopped. I will have to explain our daily processes, how information feeds into the system, how reports are generated and take her through asset allocations and possibly explain some jargons. I was better at doing a few things than explaining. Nonetheless, I met our client, I took her through the report and she understood it. That was a growth moment for me. Why? Because it substantiated my understanding of client reporting and operation processes. My biggest milestone, though, is finally being able to do an MBA. Words are not enough to express my gratitude for the support and guidance that Kgori Capital management and staff has provided over the years.

“I believe Kgori Capital has tenacity, it is innovative and more determined now than ever to serve Batswana and Botswana”.

Do you remember your first day at Kgori Capital and can you describe it?

I remember it like it was yesterday. I vividly recall being excited and intimidated, yet determined to face the challenge. I had a nervous feeling that cut through my stomach. I had just graduated with a general BA in Business Management, and I was not sure which career path to take. The job opportunity presented involvement in all areas of the business, supporting Investment, Operations and Client Services. What a platform to learn and experience all the fuss about Asset Management! More importantly, word on the street said I had just joined the best team in the industry. May I ask you, just for a second, to try and put yourself in my shoes right at that moment? I’m sure you can imagine that feeling of excitement!

How does it feel to have grown alongside the business from day 1?

It feels like a proud parent who has watched her child grow into something beyond what she imagined. We did not have a single client when we started in 2012, but fast forward 6 years later, and we have since enjoyed servicing over 20 institutional clients in Botswana. I have watched us grow and blossom, as well as battle the proverbial hail storms that come with every business. True to the Kori bird, we continue to soar against the harsh wind

What has made you stay with the business for the last 6 years and what makes you proud to be part of the team?

So many reasons come to mind. But just to mention a few: the passion, the work ethic, the culture and more importantly, the fundamental purpose for Kgori Capital’s existence. The Kgori Capital team is driven by a passion for Botswana and for excellence. Having been there the longest, I sometimes marvel at how the team came together in a way that is seamless like a neatly woven basket. We are one, we understand our mandate, we all have a winning attitude; ‘the best or nothing’ kind of attitude. We have created an environment for continuous learning, hard work, and fun. We are unrepentant of who we are and what we represent. What’s there not to be proud of?

What does the future look like for you and the team?

It can only get better. We have learned a lot in our journey. We can only improve from our previous experiences, both the good and not so good. I believe Kgori Capital has tenacity, it is innovative and more determined now than ever to serve Batswana and Botswana. With a solid team like the Kgori Capital team, the sky is NOT the limit. It has been a pleasure, to say the least.

Experienced and Deep Portfolio Management Skills

Commited to Botswana, her people and her growth

At Kgori Capital, we are passionate about Botswana’s growth, and the development of her economy and her people. Indeed, we are committed to working, as a private sector institution aligned to Government’s Vision 2036 and NDP 11, to help realise a truly sustainable, prosperous Botswana.

We are 100% Botswana citizen-owned and run, and proudly so:

Kgori Capital is a home-grown Asset Management Company that has always strived to make an enduring difference. We set out to do better for our country, and this determination only grows stronger. It is our conviction that our intrinsic understanding of the lay of the land here in Botswana provides us a distinct advantage over others.

We are grounded by strong Values:

We are patriots and thus take the responsibility that has been bestowed upon us by so many entities extremely seriously. Our brand promise has always been to “Invest with Pride” and we chose the Kori Bustard as our symbol. This great bird spends 70% of its time on foot. Our Kgori icon remains grounded, symbolising a stable, trustworthy and reliable company. The Kori Bustard is however always on the move, always learning and growing. This is what we, as Kgori Capital, are about.

A truly sustainable, prosperous Botswana

We believe Batswana have the skills, depth of talent and potential to play in even a global playing field:

We are proud to employ 12 skilled, experienced and passionate members of our team, all of whom are shareholders in our business and all of whom are Batswana; in fact, they are also predominantly women. They are passionate, young individuals. Together, they wield more than 75 years of combined experience. We lead the best Investment team in Botswana, with 3 CFA Charter holders on our investment team; this is almost 15% of the total number in Botswana.

Thus, our team is one of the most qualified, committed and able in the sector. While the trend in the sector is been a high turnover of staff at asset management companies. We at Kgori Capital have seen a steady growth curve. We are a Botswana business that has always aimed high, and we believe we are a testament to the fact that we as Batswana can make our mark and an evident difference in the market.

We are focused and determined for a sound future:

We are passionate and committed to becoming a significant participant in the Botswana investment management industry. We have ambitions to grow the firm in terms of Assets Under Management, number of clients, investment products and distribution channels, all the while working to help shape and grow our sector, and our National economy. We will invest significantly in the development of local skills and capabilities to support these growth ambitions, believing that we as Batswana have much to offer and the requisite skills and abilities to truly deliver.

We are passionate about Botswana’s growth, and the development of her economy and her people.

Click here to download full pdf