Kgori Capital Insights – Strong Fundamentals Creating Opportunities in the Botswana Coal Sector

Author Bio

Letlhogonolo Mpetsane, BSc (Mining Engineering)

Letlhogonolo Mpetsane, BSc (Mining Engineering)

Letlhogonolo is an Investment Analyst at Kgori Capital. He started his career as a Learner Official with African Copper Mining and completed the programme as a Mining Foreman. After two years, he was trained at BCL for Underground Mining, and then served as the Mine Planning Officer. He attained his BSc in Mining Engineering, with a double minor in Mineral Processing and Economics, from the Missouri University of Science & Technology in the USA.

Executive Summary

Botswana looks set to play a more prominent role in both the domestic and regional coal sector, as emerging BSE listed coal mining companies such as Minergy Limited and Shumba Energy approach important production milestones in 2018. Our fundamental forecasts suggest better prospective returns for coal related equities.

The coal sector offers significant opportunity for employment growth and economic diversification as the Government focuses on investments and infrastructure to support the growth of the domestic energy and coal export market. With the strong fundamentals for coal, we have a positive outlook for the sector.

- Global Coal production fell by 6.0% (458 million tonnes) between 2015 and 2016; double that of 2014/15.

- Global Imports and trade were up by 1.5% (14.6 million tonnes) from 2015 to 2016 even with reduced output. China alone increased imports by 25.0%.

- South Africa production down 1.4% and exports up 2.9%, resulting in a 5.8% shortage in the inland market.

- Botswana Railways (BR) and Transnet Freight Rail (TFR) discussing linking the BR network to the TFR.

- Coal prices improved by 93% to $93/tonne from the lows of $48/tonne in 2016.

Background

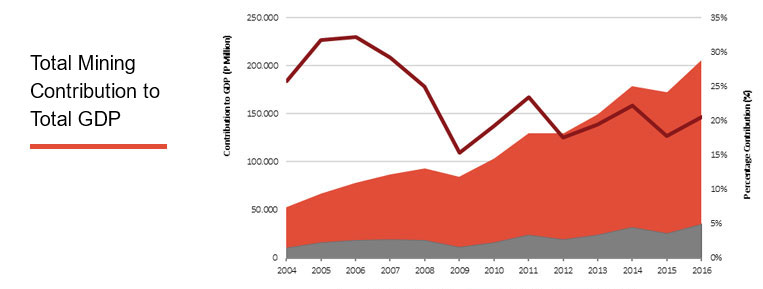

Modern mining in Botswana started with the mining of diamonds at Orapa in 1971. This was followed by Copper-Nickel production in 1973 at Selibe-Phikwe. Since the early 1980s, the mining industry has been the largest contributor to real Gross Domestic Product (GDP), contributing between 30 and 50%.

In 2013, mining accounted for 22% of Botswana’s GDP and more than 50% of Government revenues. Even though the mining sector’s contribution to GDP has been below 25% since the 2009 recession, available data indicates that the sector still leads in terms of value added contribution to GDP.

Fig 1. Mining sector contribution to GDP: Gross Domestic Product, Botswana Statistics.

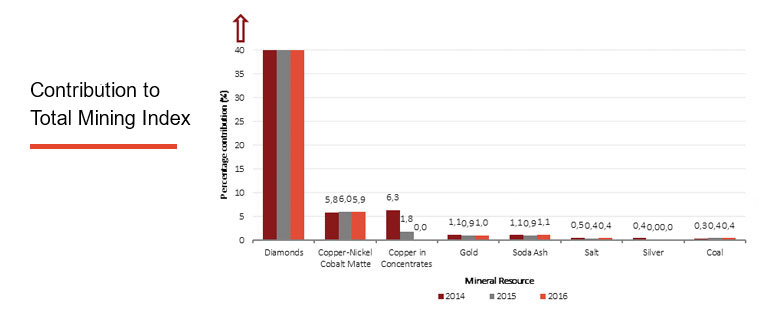

Looking at the composition of mining output historically, diamonds have been the largest contributor and remain so to date. That said, the base metals mining industry played a role through the export of Copper and Nickel Matte, as well as Copper concentrate (silver was also found in traces in the Tati Nickel deposits). These have since fallen off with the closure of BCL and Mowana Copper in the last 3 years, as illustrated in Fig 2. Outside of the resultant reduction in mining output, skilled workers are now idle and downstream industries that were dependent on the mines are under stress. What this means is that the local communities that were almost completely dependent on activity from the closed mines have seen a drastic fall in economic activity. The secondary effect of the decline in value add from mining has been a major detractor on GDP output.

Coal now presents itself as an opportunity to absorb idle miners and fill the mining output gap left behind from Copper and Nickel, with the prospect of even exceeding the contribution historically made by Copper and Nickel. Botswana has significant Coal resources that are yet to be exploited. In the recent past, significant investment has been made in the exploration of these resources by junior miners. A number of projects are now at advanced stages, delineating some of their resource to reserves.

Fig 2. Incept of Mining Production Index: Indices Of The Physical Volume Of Mining Production, Botswana Statistics.

Botswana Coal

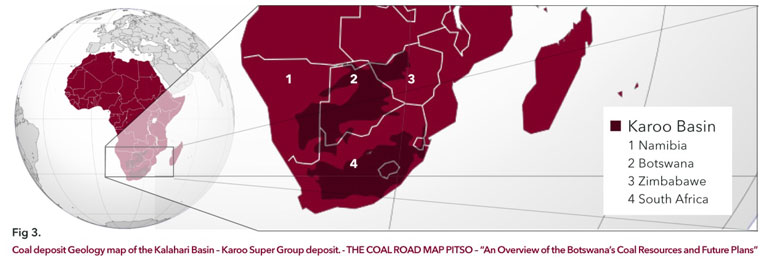

Botswana is endowed with significant Coal resources, estimated at around 200 billion tonnes. These have been explored by a number of companies from as far back as the 50s. All Botswana coal deposits occur in the Karoo Super-Group, which covers approximately 70% of the country. Drilling for coal was carried out as early as 1897, with little work having being done in the 20th century, although its potential importance was referred to from time to time. In tandem with the little exploration done, the output from Botswana is very insignificant when compared to the resources. Morupule, the only producer, currently has a planned output capacity of 3 million tonnes per annum, most of which (if not all) is used to feed the Morupule Power Plant.

Of the vast resources stated above, only 17% (35 billion tons) of the resource lies within the measured and indicated resource categorization. If an initial output of 10 million tons per annum is realised from just this portion, this could provide production for centuries just within the South African inland market. With a transition to seaborne export, the possibilities become exponentially greater.

The quality of the coal falls within the range of current global seaborne bituminous exports. The table below shows how the quality stacks up with international requirements, dependent on end user requirements. The figures are from raw coal specs and after the wash process; they will be within global specifications and requirements. This data sample is derived from washability tests that have been conducted on the coal of some junior miners in Botswana as they prepare for production.

|

BW (High) |

BW (Low) |

Newcastle Benchmark |

Richards Bay Benchmark |

|

| Energy kgcal/kg | 6 000 | 5 400 | 6 322 | 6 300 |

| Total Moisture % | 8 | 10 | 15 (max) | 15 (max) |

| Inherent Moisture % | 4 | 5 | ||

| Ash % | 13 | 20 | 14 (max) | 16 (max) |

| Total Sulphur % | 0.45 | 0.8 | <0.75 | <1.0 |

Why Coal?

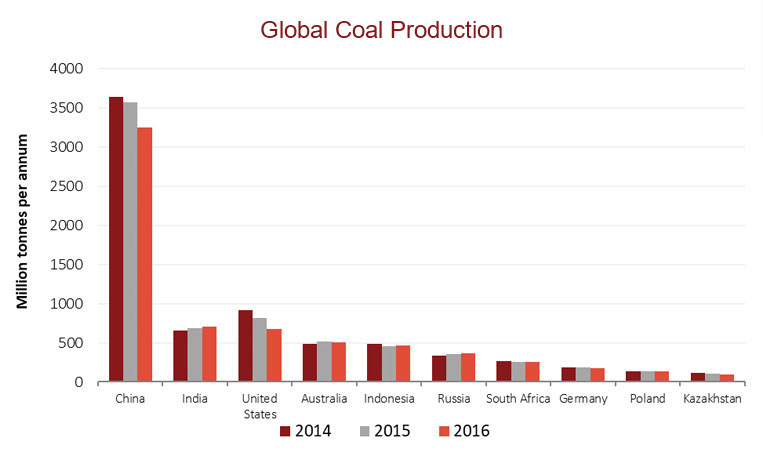

World Coal production declined in 2016 by 458 million tonnes, the largest decline in absolute terms going as far back as 1971. This decline, double the one seen in 2015, was the result of a multitude of factors; among them, the setting of quotas for mine operating days in China.

With “lower demand,” less Coal was produced in the United States, leading India to become the second largest producer with 708 million tonnes in 2016, overtaking US production for first time. Conversely, international trade increased in 2016 as imports grew by 1.5% to 1,331 million tonnes. China increased imports to 256 million tonnes, 25.0% above volumes of 2015, while Indian imports decreased to 200 million tonnes, or 7.0%. Despite the decline of Indian imports, China and India were in 2016 both the two largest producers and importers.

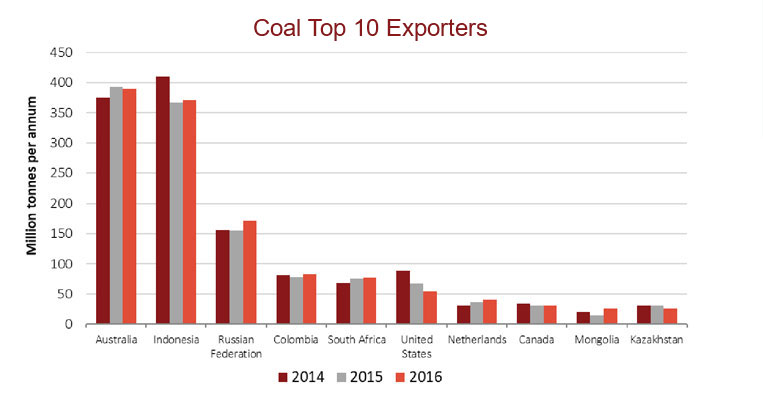

Fig 3. Global top 10 producers of coal – IEA Coal Information 2017 Overview

In total, the Asia Oceania region increased their imports to 973 million tonnes, representing 73% of global imports, showing the key role of this region in coal trade. Australia and Indonesia remained the world’s largest Coal exporters in 2016. Additionally, South Africa, Colombia and Mongolia increased their export tonnages in line with favourable market prices. India’s coal consumption increased by 2.1% in 2016, continuing 18 years of constant growth, while consumption in China declined by 1.8% in 2016. The United States production continued an eight-year decline since 2008, decreasing to 743 million tonnes in 2016, 17.4% lower than in 2015, and the lowest level since 1978.

Putting the declines for the world’s two largest economies in some context, there are currently only nine Coal producing countries that produce more than 100 million tonnes per year. China’s decline was more than the entire 2016 production of South Africa, and the United States’ decline was more than the entire 2016 production of Colombia.

Fig 4. Global top Exporters of coal – IEA Coal Information 2017 Overview

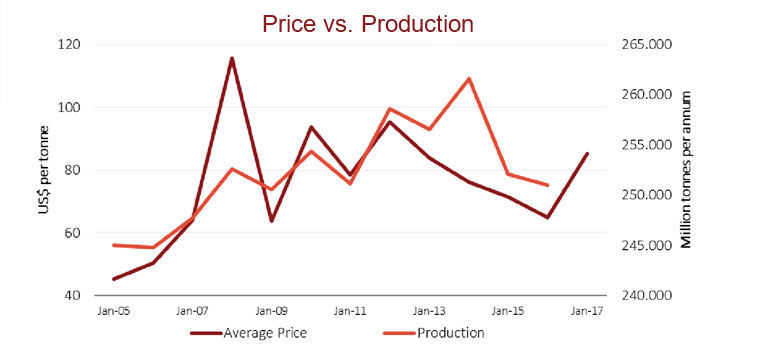

Coal, a high margin, bulk commodity, has been on a price rally on international markets, as is the case with other commodities in 2018. Since the coal price crash of 2009, the route to monetize coal in Botswana has been through the export of power, which most players have been focused on. However, we feel that a slight shift in focus from Coal for power to Coal for export will prove to have significant impact on the potential of the industry.

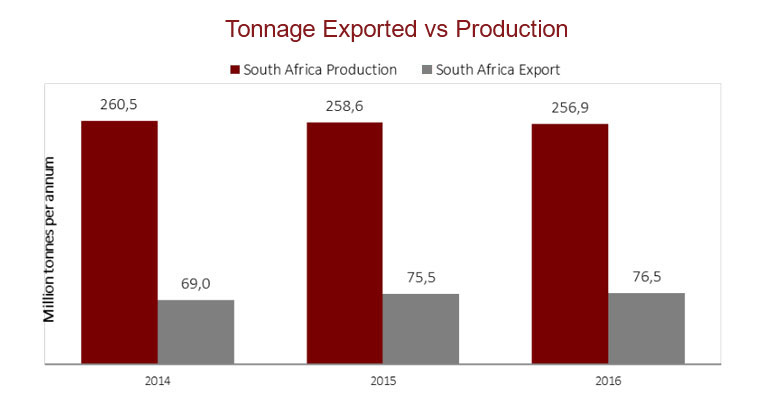

Fig 5. Annual RSA production, 2004-2016, CHAMBER OF MINES OF SOUTH AFRICA FACTS AND FIGURES.

China, the world’s third largest importer (Japan and India are ranked first and second) has changed its focus towards sustainable, consumption-driven economic growth. This led to tightened regulations and production cutbacks, thereby reducing in-country coal production by 500 million tonnes per annum.

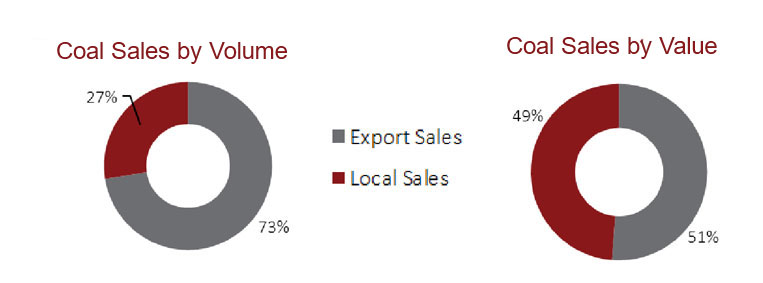

The cut-back increased China’s appetite for seaborne Coal, which led to a rally in export coal prices. In response, large producers in the South African market diverted their coal to the seaborne market, not only for economic reasons, but also to meet their quotas on the Transnet Freight Rail (TFR). Fig 6. illustrates how, South African producers have been mostly focused on export, but the value generated from the combined sales was largely a component of the local market. Fig 7. shows the deficit and potential market within the South African borders. With the reduced production and increased export tonnages, this has created an 8.4 million tonne gap between 2014 and 2015, and a further 2.7 million tonnes between 2015 and 2016, thus bringing the shortfall in supply within the local market to 11.1 million tonnes within the 2-year period.

Fig 6. Coal sales by volume and value: 2004-2016, CHAMBER OF MINES OF SOUTH AFRICA FACTS AND FIGURES.

Fig 7. Coal production vs export figures in South Africa. – IEA Coal Information 2017 Overview

There has been no new investment of any significance in the Coal industry globally since 2009, in most cases production was reduced and some mines mothballed. Since the resurgence of the Coal price, new production in South Africa has been constrained by the revised Mining Charter and tighter environmental regulations in the Waterberg area. A combination of the reduced production and re-directing of Coal for export has resulted in a shortfall to South African industrial coal consumers of approximately 13 million tonnes per annum; this gap is projected to go up to 383 million tonnes per annum by 2030. The inland market prices have also performed very well, closely trailing the Richards Bay FOB currently at $93/tonne, a significant jump from the global crash where prices hovered at $40/tonne.

Botswana producers are currently estimating their production capabilities at around one million tonnes per annum. The regional demand gap can therefore absorb all the planned production and support any further investment in Botswana. Botswana producers have a distinct advantage over other Southern African producers, as our deposits are closer to the consumer.

The biggest challenge that has faced potential Botswana producers in past has been the logistics, particularly transport, with the absence of a rail line and the distance by road from the ports. This has been alleviated by the emergence of supply gaps in markets close enough to assets to make road transport viable. Another positive is the ongoing dialogue between Botswana Railways (BR) and Transnet Freight Rail (TFR). This seeks to establish a rail link that will connect the BR network to the TFR network (through Tshele hills). This would provide for much less prohibitive rail transportation costs which could even avail the seaborne market as a potential for the local coal industry.

However, time is of the essence as widespread interest is returning to the commodity. The first mover advantage will play a significant role in capitalising on the current price rally before supply and demand rebalance. A risk to Coal is the drive for clean energy across the globe. With Coal currently making up 41% of global electricity production and 29% of primary energy demand, the substitution will take some time; for now, Coal remains very relevant.

What to consider when evaluating a Coal project.

At Kgori Capital, we believe there are various factors that go into the process of making an investment decision for a Coal opportunity; however, listed below are the more significant ones:

Do the quantity and quality of mineralisation meet requirements?

The mining company begins by estimating the quantity and quality of mineralisation i.e. the mineral resource. It carries out drilling to obtain soil samples. Once drilling has revealed the presence of a mineral resource, the next step is to determine whether the deposit can actually be mined.

Preliminary economic assessment and feasibility studies

The mining company will conduct the following assessments:

- Preliminary economic assessment: to tell investors whether a mining project has the potential to be viable; and

- Prefeasibility and feasibility studies: to determine with more certainty whether the mining project is viable.

These studies analyse and evaluate economic, technical and geological factors.

Is the project profitable?

The company must evaluate the economic profitability of the project, including whether the price of the ore on world markets will justify the investment.

- Uncertainty about the future price of ore could make it more difficult to obtain funding for the project;

- The mining company must clearly evaluate the technical feasibility of the project. What infrastructure will be needed for extracting and grading of the ore? Is the deposit easily accessible? Have the technologies been proven? and

- The company must take the project’s environmental and social aspects into account. Is the project being accepted by the nearby communities? How far away is transportation access?

Throughout the assessment process, the company’s officers and experts must determine whether the project justifies the large sums of money that will be needed to operate the mine. At each stage, the officers may put the project on hold until optimal conditions materialise (such as increased demand for the commodity). They may even decide to abandon it altogether.

Mining operations

Once the mining company has determined that the project would be profitable, it must obtain the funding required for the development, infrastructure and mining of the deposit. Such work can take a long time and cost a lot of money. For example, it can take 12 to 36 months for such work to be completed and millions of Pula of investment capital may be required.

The success of a mining project depends to a large extent on the quality, integrity and competence of the mining company’s officers; however, external factors also play a role. For example, an unexpected drop in the price of the commodity could compromise the mining operations, despite the sums of money already invested. This is a factor often out of the control of the mining company, and yet with significant bearing.

Is Botswana positioned to take advantage of the market?

A number of projects are at advanced stages, however, BSE listed Minergy and Shumba Energy stand out. Both possess adequate resources in their prospecting licences and have done significant work proving the existence and quality of the resource. Minergy, a recent entrant to the market, has been swift in meeting permitting requirements and other developmental milestones; their target being to begin production by year end. The team’s experience, both operationally and in the marketing sphere, gives them an edge in being able to deliver a successful operation within their tight timelines. Shumba has made headway on the marketing front, establishing themselves in the South African inland market as upcoming Coal traders and securing some deals. Once the company goes into production, these relationships will work well for them.

The Government has been firmly supportive of the development of the Coal market, working with the project promoters to ensure compliance with local laws and regulations. This will facilitate a more efficient route to market for Coal producers.

Conclusion

Kgori Capital is reasonably bullish on the Coal mining sector fundamentals. We believe that the local market exists and the players are in a better place to significantly improve the prospects of monetising Botswana’s reserves. This provides an opportunity for investors willing to thoroughly analyse and evaluate prospects available on the market. We cannot overstate the significance of the shift in focus from Coal for power to Coal for export and the opening that provides for emerging local coal producers.

The absence of new investment in the Coal industry over the last decade has been a drag on global production growth and has resulted in a supply gap for the regional inland market. At the same time, the popularity of a safety-in-numbers approach of low to no investment in resource stocks by local fund managers has also meant significant underinvestment in the sector over the last decade.

We acknowledge that our investment view on coal does not come worry-free. Allocators of long-term capital must always mind the risks, but many of these risks have softened with the improving fundamentals of the sector.

Invest with pride

Glossary

- Resource – refers to the total amount of a material or primary energy flow that exists. This includes fuel that is both discovered and undiscovered, economically recoverable or not economically recoverable.

- Reserve – reserves are deposits of fossil fuels that are known to exist with a reasonable level of certainty based on geological and engineering studies.

- Measured – well defined resources as the result of a tight drill hole matrix. Measured resources are assumed to be fully bankable as there is little chance of your assumptions being incorrect due to such tight drill hole spacing.

- Indicated (Proven and Probable)- Somewhat well-defined resources which have a high certainty of being there but are somewhat less reliable than measured resources as drill hole spacing is much greater than in an area of measured resources.

- Inferred – These resources are not based on any drill-hole campaign and are an educated guess regarding the mineral reserves in the area in question.