Guest Column: Getting Back On Track Financially After The Holidays

December is probably the one month in the year most people look forward to. And for good reason; December is marked by taking time off work, spending time with family,travelling to our home villages or going on holiday and celebratory occasions such as weddings, Christmas and New Year, to name a few.

Soon after comes January, the month that is now infamously known in Botswana as ‘Janworry’. In this month, most survive on a shoestring but due to December overspending. January is the hangover that comes after the long December parts were, the heavier the ‘financial hangover.”

The question now becomes, with the festivities behind us, how do you recover financially? Here area few ideas to help you get back on track financially and help you avoid getting off track during the next holidays.

1. REFLECT AND ANALYSE

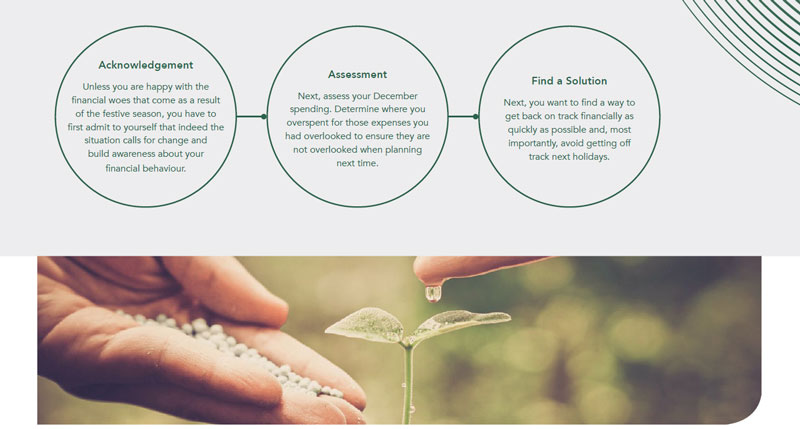

For most of us, this is not the first time we have found ourselves with a few financial regrets due to over-spending in December. Year after year we make the same mistake of not planning well for our finances or, if we do, we tend to go over budget once we are in the festive spirit. The best way to avoid repeating the same mistake is to reflect on the situation and this involves acknowledgement, assessment, and finding a solution.

2. GO ON A SPENDING DIET

Very little can be done to recover from financial over-indulgence except going on a spending diet. Trimming unnecessary expenses in the first few months of the year frees up some money to ensure a faster financial recovery. Freeing up as much money as possible will enable you to pay off your debts faster and/or replenish any savings eroded during the festive excitement. Additionally, a spending diet will help you avoid getting into more debt

while recovering.

3. TAKE CARE OF DEBT NOW

Debt erodes your disposable income and the more debt you have the less disposable income you are left with every month. Now that the festivities are over it is time to clean up. Clearing your debt is a significant part of cleaning up. It is best to tackle debt by using one of these methods:

a. Payoff high interest debt first – Rank your debt in a descending order by interest rate. Start by paying off your high interest debt first (making minimum payments on other debt) as this is the most expensive debt you have. Once the high interest debt is paid off, move on to the next high interest rate and descend down your debt until finishing off with your cheapest (low interest) debt.

b. Snowball method – With this method, you pay more towards the smallest debt while making minimum payments on other debt. This allows you to quickly pay off this debt. Once this debt is paid, use the freed up money to pay your next highest debt. Continue with this method – using freed up money to pay off the next debt – until all debt is paid.

4. PLAN YOUR NEXT HOLIDAY SPENDING

Having reflected and analysed your recent festive spending, you will be in a better position to plan for the next holiday. It is always best to start planning well ahead of time. Now is the best time to start thinking about it; if and where you will be spending the holidays, any gifts you will be buying, any groceries to be bought for yourself or your parents, etc.

To ease the next December financial burden, it is also a good idea to start buying gifts, December groceries and other things during the year. By spreading out your December expenses over the year, you relieve yourself of the inevitable December financial pressure. As strange as it may sound, shopping for Christmas in July or September is a great idea!

5. SAVE AND INVEST FOR FUTURE EXPENSES

The best way to prepare yourself for the next holidays and avoid future festive financial woes is to save and invest for your Christmas spending in advance. Acknowledging that December expenses are higher than normal and saving for this extra spending makes you prudent.

Saving, even a little bit, for the festive season is much better than not saving at all. It is not necessary to save for all your December expenses but saving for some goes a long way in relieving the December financial pressure.

FINAL THOUGHTS

December is a joyous and merry season that we all look forward to every year. Failing to plan for the festive season, however, can be a detriment to our financial plans for the New Year. With the2019 festive behind us, I hope we will use the few tips shared here to improve our future experience and give ourselves the gift of a financially painless transition from one year to the next.

Click here to read full article

Bupelo Moalusi

Financial Advisor, Triscend