Emotional Investing

Although it is easier said than done, emotions do not have a place in your investment journey. A significant portion of portfolio losses are due to emotional decisions made by investor and investment manager alike, leading to irresponsible or otherwise ill-informed decisions.

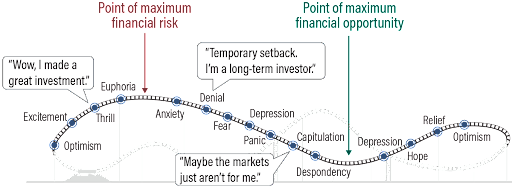

Most people buy into investments because they are hyped on media platforms. Likewise, they will also then sell because of widespread panic or disfavor from the media or from friends and family. The truth is, with today’s financial markets, information is rapidly incorporated into the price of assets, so if you are akin to emotional investing, you are bound to buy when everybody else is (hence at price peaks) and sell with everyone else (hence at price troughs/lows). By doing this you are obstinately defeating the law of buying low and selling high and you will seldom make a profit investing.

Figure 1 invest “the pitfalls of investor cycles” by www.amgfunds.com

The points at which we are likely to make the best investment buys take the toughest toll on emotions because they are usually trying times for the market, when prices are at their lowest. Disposing of assets at their price peaks is equally difficult as it requires letting go of something that is doing exceptionally well. Undoubtedly, it seems dumbfounded to dispose of an asset that is its prime, perhaps even irresponsible, but this is what a good investor does.

Emotional investing goes beyond the buy low sell high principle and its complexities. More often than not, we are attracted to certain investments because of their familiarity. For instance, most of us will at some point buy and develop some land from our home villages even though that money could possibly have been better spent somewhere else. We will also be drawn to buy shares of companies we know, that we buy from every day, or see frequently on the news, simply because the name is familiar. While there is nothing fundamentally wrong with buying familiarity, the point is, without proper research into the asset we are buying, we will often incur significant losses.

Now that we understand what emotional investing is, and that it is seldom a good resolution, here are a few ways to avoid getting caught up in your own emotions.

- Have a solid investment strategy; the importance of starting your investment journey with a solid strategy cannot be overemphasized. As with life in general, having a good plan will help you overcome the emotions when the going is tough. It will also help you keep a cool head when there are seemingly better opportunities outside of your investment focus, because let’s be honest, there will always be better opportunities out there.

- Diversify your portfolio well; Another aspect that cannot be overemphasized. Sometimes you do make the wrong investment decisions. And sometimes the best investment assets go through the toughest of times. With a well-diversified portfolio, you are more equipped to absorb minor shocks to your portfolio. In any case, the shocks will only be minor if you have diversified well.

- Invest over the long-term; It is entirely possible to buy and sell securities in the short-term for a profit, especially with the advent of the Total Portfolio Approach. However, this approach is both stressful and not sustainable. When you think long-term, it is easy to not get distracted by short term events. If you’ll notice, breaking news only ever lasts for a short period of time, sometimes a couple of hours or days. It is probably worthwhile hence to not make long term decisions based on short term events. So, again, think long term.

- Use dollar cost averaging; We will explore dollar cost averaging extensively in a separate article. This strategy entails buying investments at timed intervals to take advantage of price fluctuations. Because you are buying at different price levels, you are likely to buy at highs and lows alike, hence you are taking the complexity out of trying to time your investments. It also significantly reduces the emotional component in trying to time your investment buys or sells.

Avoid emotional investing. Happy investing!

This article was authored by Kgori Capital, a leading asset management firm.