Market Insights – Botswana Fixed Income and Macroeconomics

Market Review

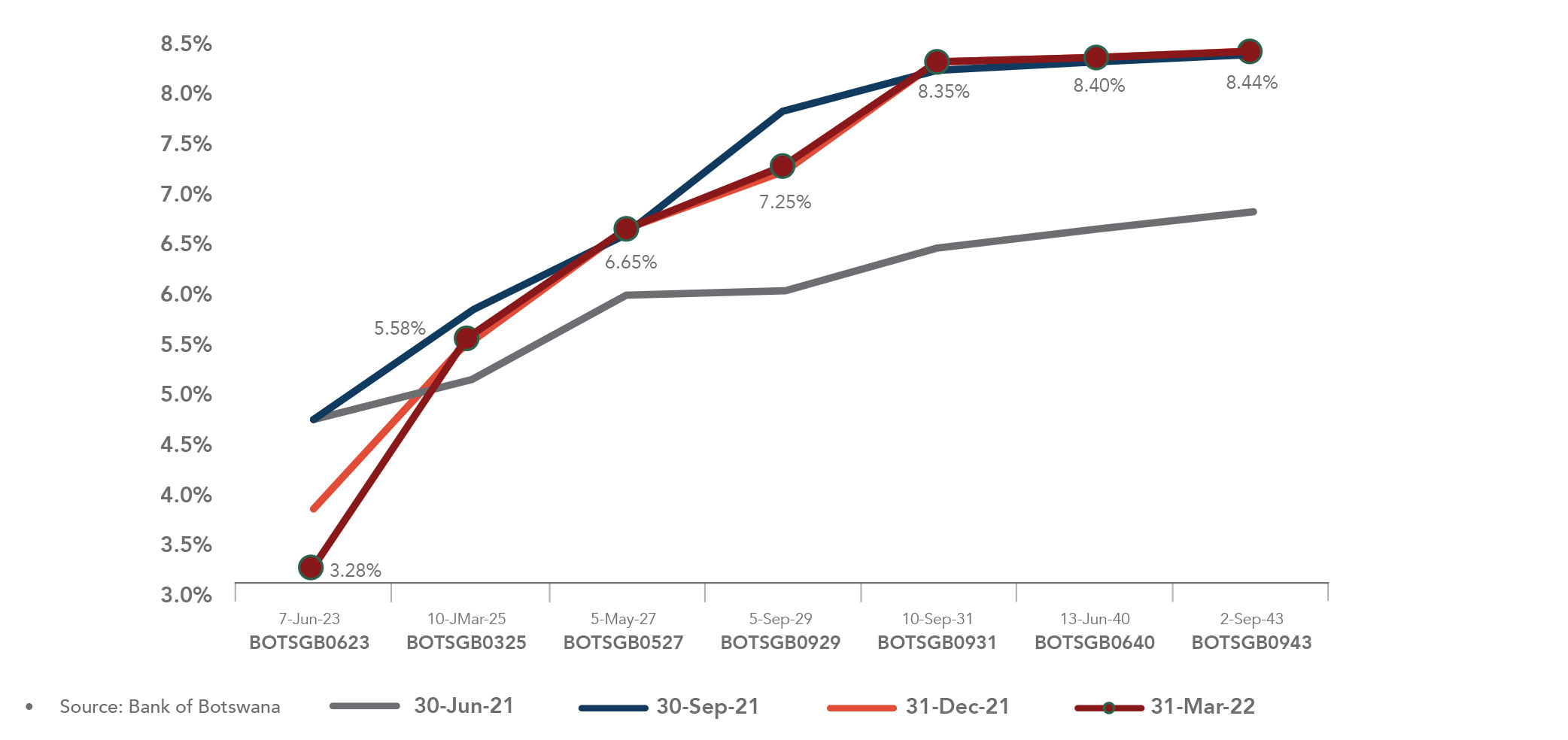

The FABI returned 1.6% for the quarter mainly attributable to coupon returns as prices in general, remained stable. Overall, the Government Bond par curve continued to steepen as the short-to-mid section of the yield curve declined once again whilst the longer end of the yield curve remained stable.

We increased our forecast for average inflation for the calendar year 2022 to 8.2% (previously: 6.6%).

The BoB released its 2022 Monetary Policy Statement (MPS), wherein it announced reforms to its Monetary Policy Framework.

We expect the BoB to implement at least one rate hike in 2022 as it walks the tightrope between rising inflation, which has been mainly supply driven, and supporting economic growth.

Chart 1:

GOVERNMENT BOND YIELD CURVE CHANGES

There were three Government bond auctions held during the quarter where P4.5bn of bonds and T-Bills were offered. Demand was moderate with P5.9bn of bids received. The auctions were under allotted but the allotment ratio (actual allotment divided by securities on offer) increased to 70.6% from 57.4% in Q4 2021. The bulk of the allotment was at the short end of the curve where P2.3bn (72.9% of total allotment) of T-Bills were issued.

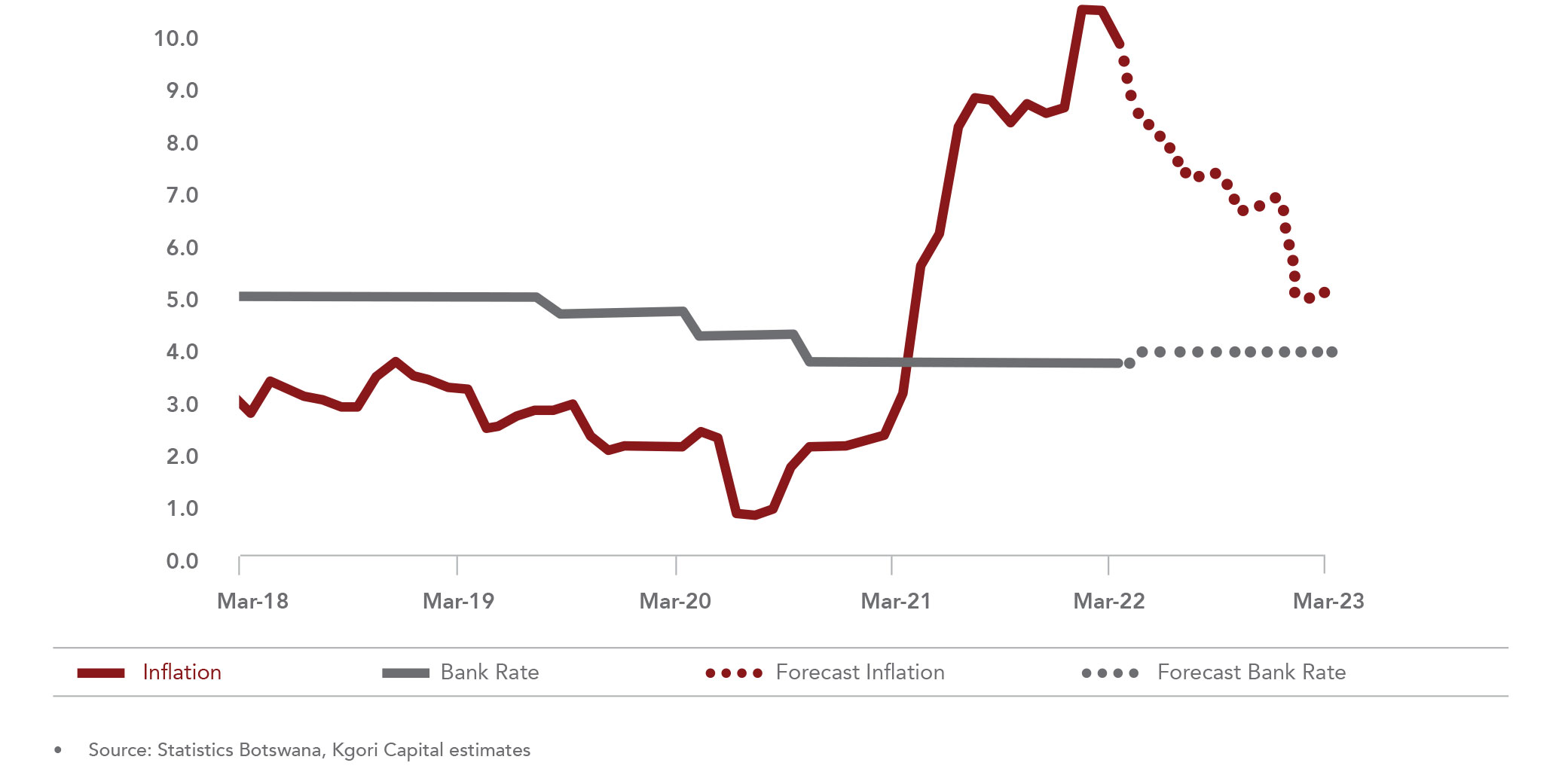

Bond yields appear to have stabilised but there is still more supply pressure expected as Government plans to run a deficit budget for the 2023 financial year which is expected to be partly funded by local bond issuance. Inflation continued to trend above the Bank of Botswana’s (BoB) 3.0%-6.0% objective range with March 2022 inflation coming in at 10.0%, decelerating 0.6% from the 10.6% registered in February 2022. The decrease was driven by a drop in Transport inflation by 3.2% to a still elevated 23.8% y/y in February 2022.

Chart 2:

BOTSWANA CPI (Y/Y %)

There was only one BoB Monetary Policy Committee (MPC) meeting held during the quarter. The MPC maintained the Bank Rate at 3.75% despite inflation continuing to trend above the upper bound of its objective range.

The MPC maintained its view that the current pickup in inflation is transitory (due to factors such as increase in VAT and fuel pump prices) and hence maintained its accommodative position. The MPC slightly raised its inflation expectations and now expects inflation to average 7.2% in 2022 from 7.0% previously.

A trade surplus of P0.7bn was recorded for the month of December 2021. On a Last-Twelve-Months (LTM) basis, the trade deficit stood at P10.5bn in December 2021, a contraction of P14.9bn versus the P25.4bn LTM deficit recorded in December 2020. The main driver behind the improvement in the deficit was the continued normalisation in diamond trade which registered a surplus of P5.1bn in December 2021 and a much improved LTM trade surplus of P41.5bn versus the P20.2bn recorded in December 2020.

The Minister of Finance and Economic Development, Honourable Peggy O. Serame, presented the 2022 Budget Speech to parliament. The Minister highlighted that she expected a budget deficit of P7.0bn (3.2% of GDP) for the 2023 financial year end (FY23).

Despite the expectation of a budget deficit in FY23, the budget is contractionary in nature with Government focused on cutting excess wastage in order to fund development projects. In order to reign in spending wastage, a new three stage project appraisal process will be used. Government will make a marked attempt to reduce its wage bill by identifying scarce skill allowances which are no longer justified and is making a concerted effort to reduce subventions to parastatals and local authorities.

Government will be focused on implementing ongoing projects which it believes will drive future growth. In this regard, the development budget was increased by P1.8bn to P16.4bn, of which 82% was allocated for already ongoing projects and programmes. In order to ensure adequate availability of funding for its deficit, the Government will also introduce measures to improve the functioning of the local debt market.

The BoB released its 2022 Monetary Policy Statement (MPS), where it announced reforms to its Monetary Policy Framework as follows:

1. Changed the anchor rate from the Bank Rate to the 7-day BoBC which will now be called the Monetary Policy Rate (MPR);

2. Changed the auction format for the 7-day BoBC to a fixed rate full allotment system from the current multiple price system;

3. Established a 200bps interest rate corridor comprising a Standing Deposit Facility, at 100bps below MPR, and a Standing Credit Facility at 100bps above MPR;

4. The Credit Facility Rate will now be anchored on the MPR plus a margin to be determined by the BoB given prevailing circumstances. In the current market the margin will be set above the MPR;

5. Liquidity absorption and injection will now take place on a less frequent basis and will be conducted at the MPR;

6. Introduced a 1 month BoBC to help address some of the structural liquidity positions and support construction of the short end of the yield curve; and

7. Commercial banks will now set their own Prime Rate.

The changes introduced were done in order to facilitate a more effective Monetary Policy transmission mechanism. There will be a transition period of at least one year, ending 31 March 2023. January 2022 credit growth moderated to 4.7% y/y from 5.1% y/y in December 2021.

Household credit growth moderated by 0.4% to 6.0% y/y in January owing to a general deceleration in growth across segments. Business credit growth on the other hand increased by 1.0% to 4.8% in January driven by upsurge in lending to Business Services, Real Estate and Finance sectors.

BoB released the results of its 2020 Household Indebtedness Survey Report. The report highlighted that overall most credit (70.6%) was channelled to the most productive age group of the population i.e. 30-50 years old, which, in line with the consumption smoothening concept of the life cycle income hypothesis.

This is supportive of welfare enhancement and economic growth and development. The BoB concluded that with household credit amounting 31.7% of GDP in 2020, there continues to be scope to significantly increase the comparative size of credit relative to the economy.

OUTLOOK

Interest Rates

We expect the BoB to implement at least one rate hike in 2022 as it walks the tightrope between rising inflation, which has been mainly supply driven, and supporting economic growth.

Infloation

We have increased our forecasted inflation levels for 2022 on account of expected high transport and food inflation. We increased our average inflation for the calendar year 2022 to 8.2% (previously: 6.6%). We now expect inflation to only print within the BoB’s objective range in Q1 2023 driven by base effects.

Download as PDF (Kgori Domestic Fixed Income and Macro Commentary Q1_2022)