Market Insights: Botswana Fixed Income and Macroeconomics

Market Review

The FABI generated a negative quarterly return, with the index declining by 0.3% for the quarter. Government bonds were the main reason for the decline, registering a return of -0.4% for the quarter. Corporate bonds generated positive returns of 0.9% for the quarter.

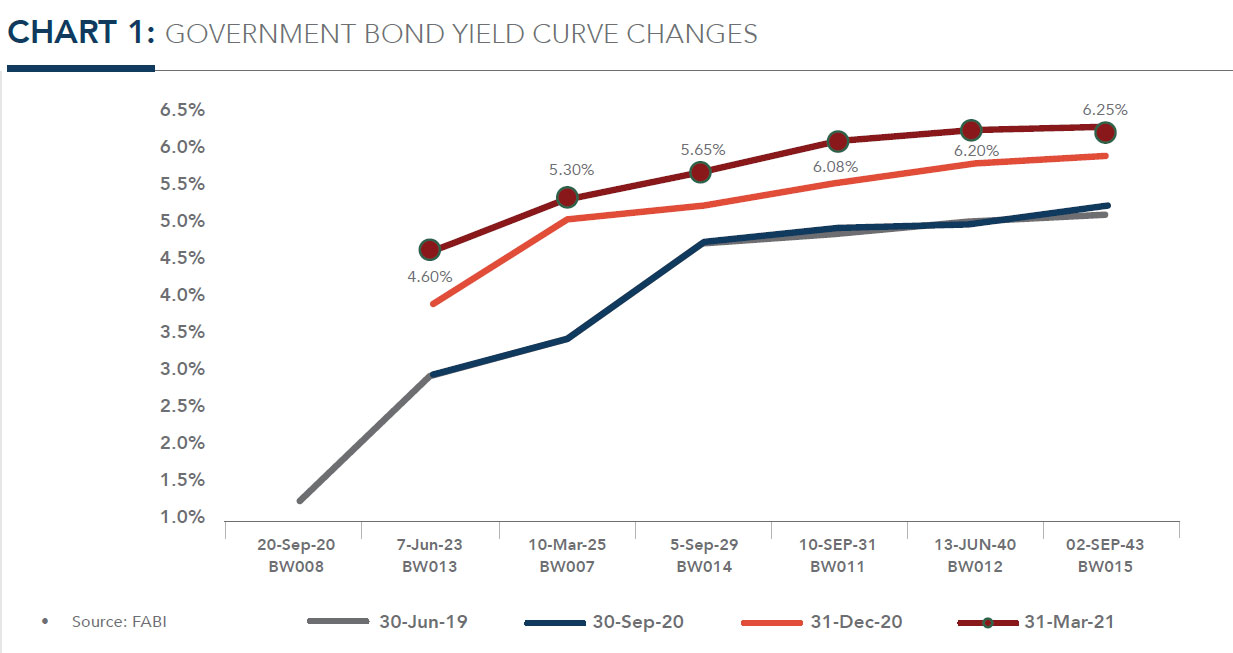

Government bonds have continued to come under pressure due to increased supply as the Botswana Government looks for funding for its Economic Recovery and Transformation Plan (ERTP). Yields rose by at least 30bps across the yield curve with the yield of the BW013 (2-Year), BW007 (4-Year), BW014 (8-Year), BW011 (10-Year), BW012 (19-Year) and BW015 (22-Year) rising by 70bps, 30bps, 45bps, 58bps, 42bps and 39bps respectively.

There were three auctions held during the quarter where P8.6bn of bonds and T-Bills were offered. There was decent demand with P10.8bn of bids received, however, in a similar manner to Q4 2020’s auctions, all auctions were under-allotted with an allotment ratio (allotment divided by securities on offer) of 59.0%. The low allotment was likely due to bids received considered too rich.

The key question remains how the Government plans to fund its projected deficits. Even with the possibility of securing bilateral funding, there is an increased likelihood that projects under its ERTP may be delayed.

Inflation breached the lower bound of the Bank of Botswana’s (BoB) objective range, ending the quarter at 3.2% in March 2021. The main driver of inflation was Transport inflation which moved out of deflation territory as a result of the ~6.9% (~54t) increase in pump prices effected in March 2021.

We expect inflation to accelerate further and briefly touch the 6% upper bound of the BoB’s objective range in late Q2 2021/Q3 2021 before decelerating. Our expectation is premised on continued supplypush inflation and base effects arising from the Transport basket.

The main upside risks to our outlook remains higher than expected Food and Transport inflation while the main downside risk remains lacklustre domestic demand.

Click here to read full article